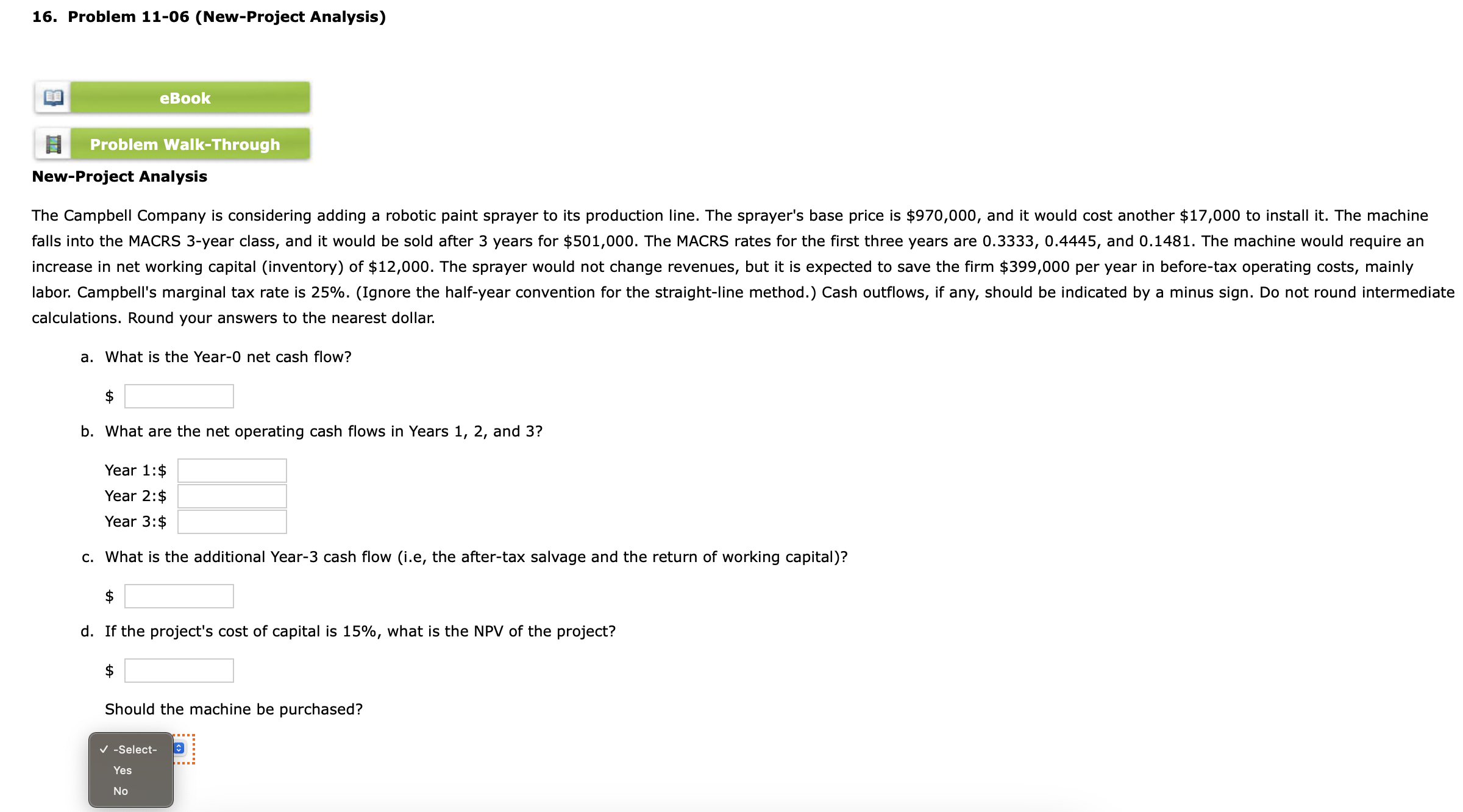

Question: 16. Problem 11-06 (New-Project Analysis) New-Project Analysis calculations. Round your answers to the nearest dollar. a. What is the Year-0 net cash flow? $ b.

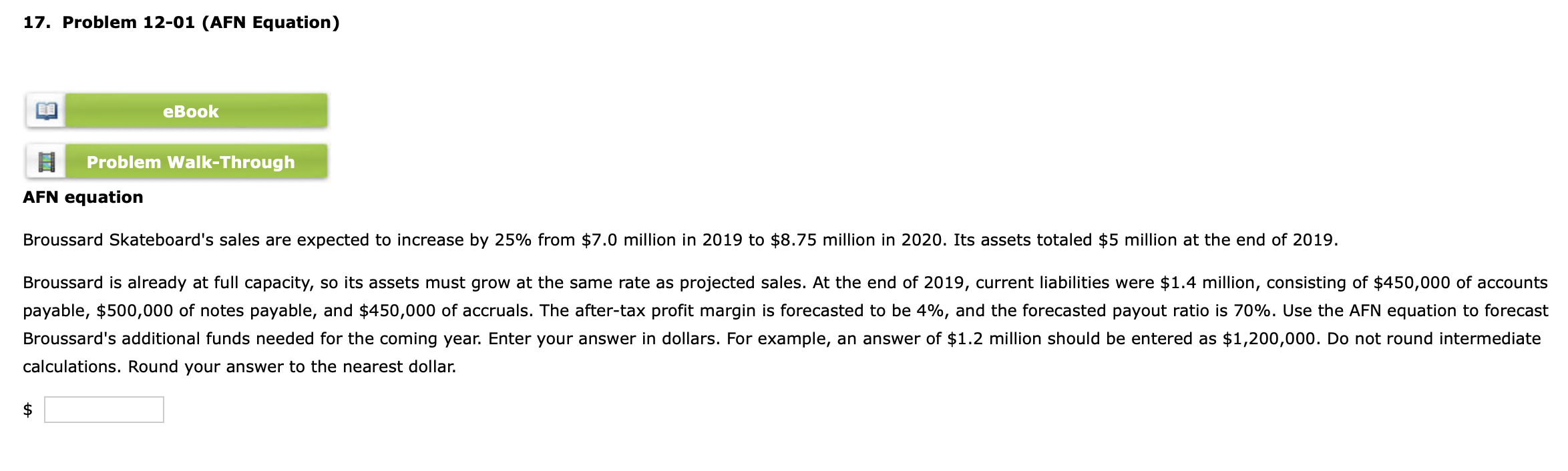

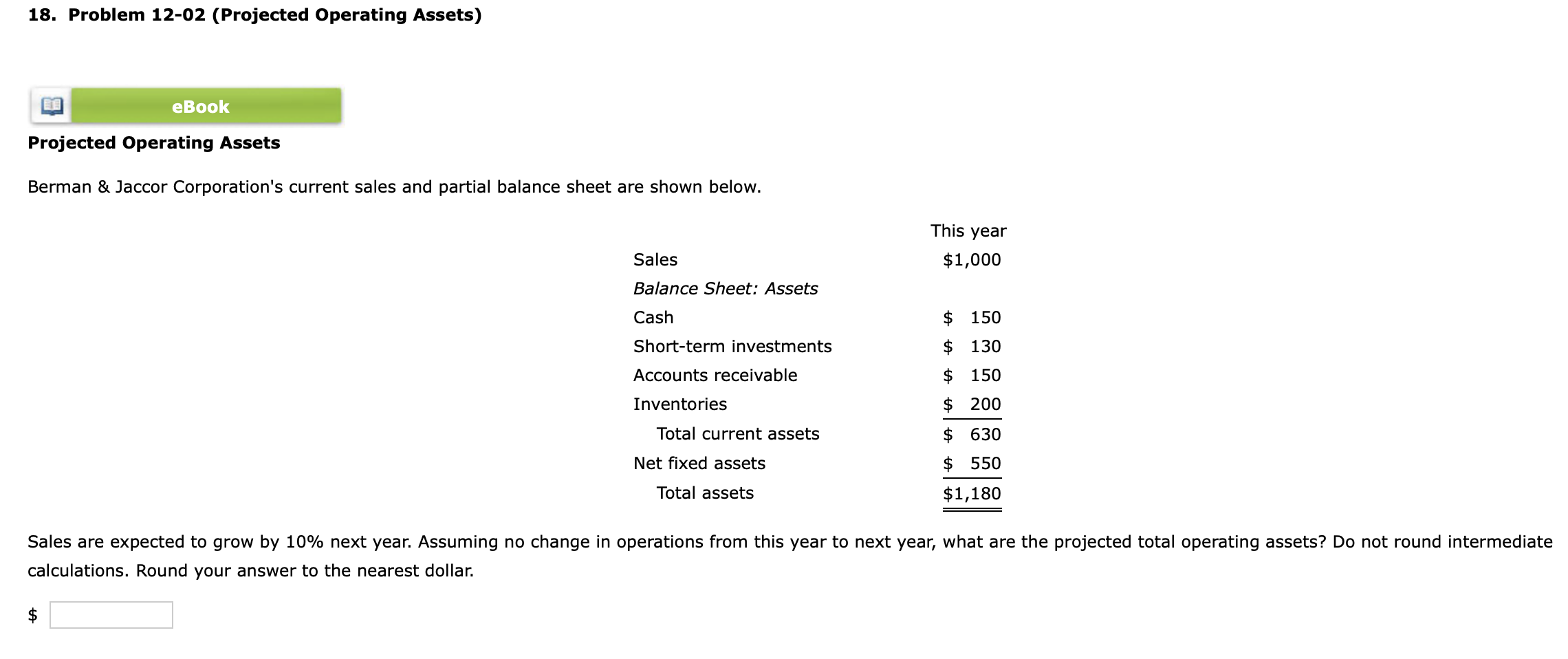

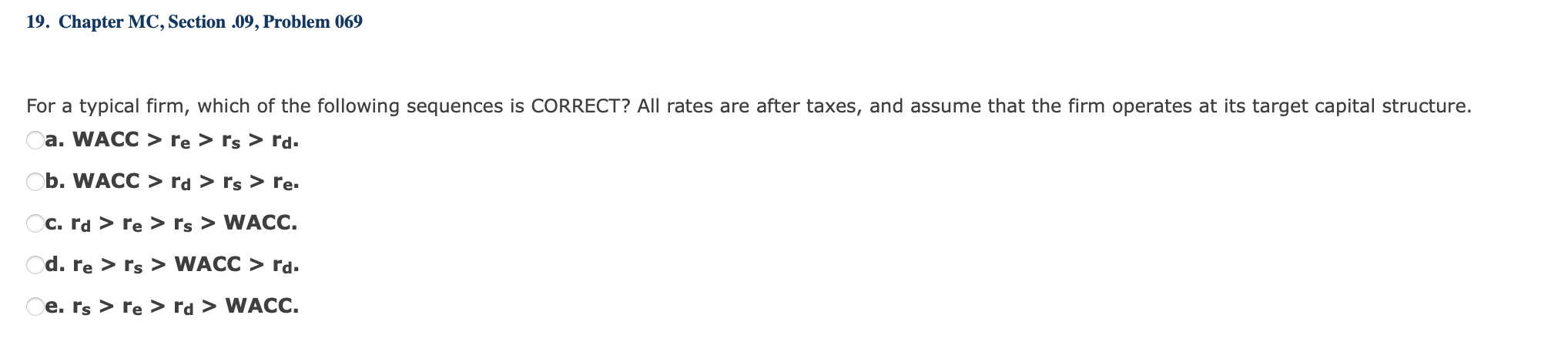

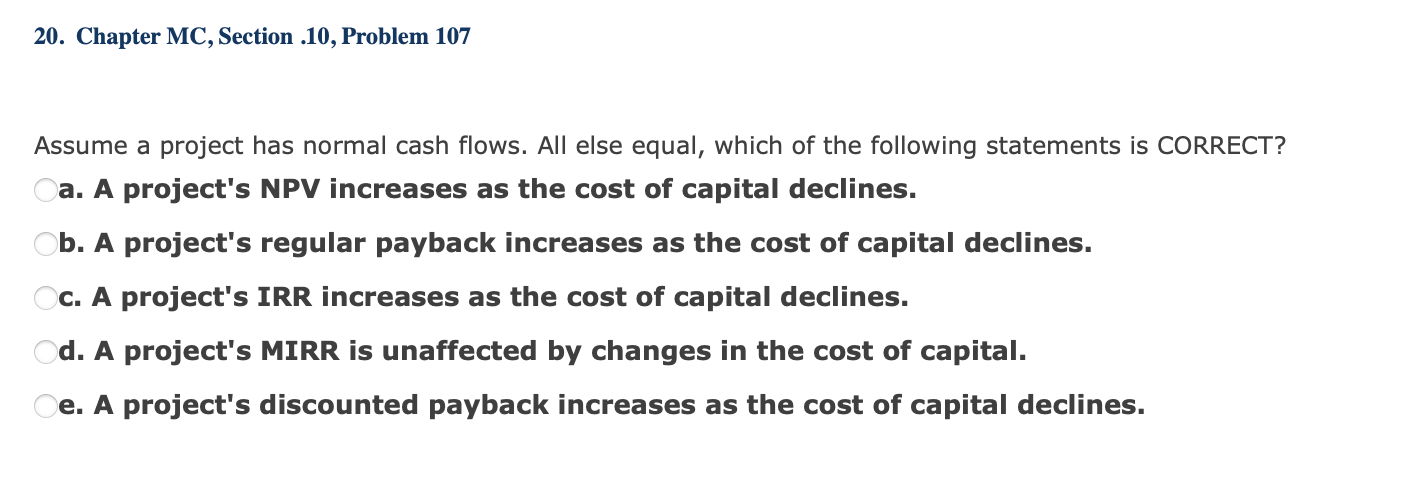

16. Problem 11-06 (New-Project Analysis) New-Project Analysis calculations. Round your answers to the nearest dollar. a. What is the Year-0 net cash flow? $ b. What are the net operating cash flows in Years 1, 2, and 3? Year 1:$ Year 2:$ Year 3:$ c. What is the additional Year-3 cash flow (i.e, the after-tax salvage and the return of working capital)? $ d. If the project's cost of capital is 15%, what is the NPV of the project? $ Should the machine be purchased? 17. Problem 12-01 (AFN Equation) AFN equation calculations. Round your answer to the nearest dollar. 18. Problem 12-02 (Projected Operating Assets) Projected Operating Assets Berman \& Jaccor Corporation's current sales and partial balance sheet are shown below. calculations. Round your answer to the nearest dollar. 19. Chapter MC, Section .09, Problem 069 For a typical firm, which of the following sequences is CORRECT? All rates are after taxes, and assume that the firm operates at its target capital structure. a. WACC >re>rs>rd. b. WACC >rd>rs>re. c. rdd>ree>rs> WACC. d. re>rs> WACC >rd. e. rs>re>rd> WACC. 20. Chapter MC, Section .10, Problem 107 Assume a project has normal cash flows. All else equal, which of the following statements is CORRECT? a. A project's NPV increases as the cost of capital declines. b. A project's regular payback increases as the cost of capital declines. c. A project's IRR increases as the cost of capital declines. d. A project's MIRR is unaffected by changes in the cost of capital. e. A project's discounted payback increases as the cost of capital declines

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts