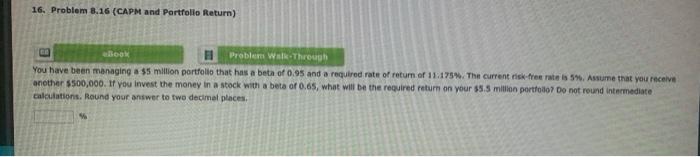

Question: 16. Problem 3.16 (CAPM and Portfolio Return) eBook Problem Walk Through You have been managing a $5 million portfolio that has a beta of 0.95

16. Problem 3.16 (CAPM and Portfolio Return) eBook Problem Walk Through You have been managing a $5 million portfolio that has a beta of 0.95 and a required rate of return of 11.175%. The current risk-free rate is 5%. Assume that you receive another $500,000. If you invest the money in a stock with a beta of 0.65, what will be the required return on your 55.5 million portfolio? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts