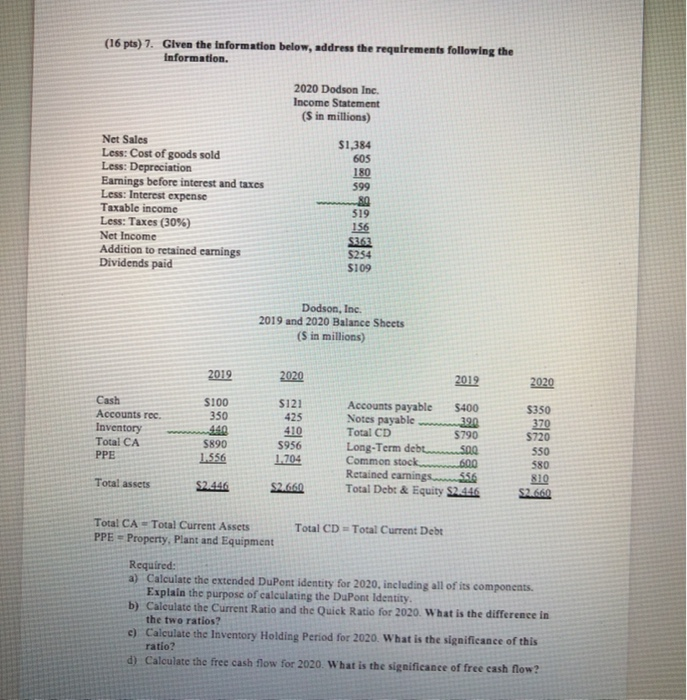

Question: (16 pts) 7. Given the information below, address the requirements following the Information. 2020 Dodson Inc. Income Statement (S in millions) Net Sales Less: Cost

(16 pts) 7. Given the information below, address the requirements following the Information. 2020 Dodson Inc. Income Statement (S in millions) Net Sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest expense Taxable income Less: Taxes (30%) Net Income Addition to retained earnings Dividends paid $1,384 605 180 599 -80 519 156 $3.53 $254 $109 Dodson, Inc. 2019 and 2020 Balance Sheets (5 in millions) 2019 2020 2012 2020 Cash Accounts rec Inventory Total CA PPE $100 350 440 5890 1.556 5121 425 410 5956 1.704 Accounts payable $400 Notes payable 390 Total CD $790 Long-Term debt 500 Common stock 600 Retained carings 556 Total Debt & Equity S2.446 $350 370 $72 550 580 810 S2.60 Total assets 52.446 S2.660 Total CA - Total Current Assets PPE = Property, Plant and Equipment Total CD - Total Current Debt Required: a) Calculate the extended DuPont identity for 2020, including all of its components. Explain the purpose of calculating the DuPont Identity. b) Calculate the Current Ratio and the Quick Ratio for 2020. What is the difference in the two ratios? c) Calculate the Inventory Holding Period for 2020. What is the significance of this ratio? d) Calculate the free cash flow for 2020. What is the significance of free cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts