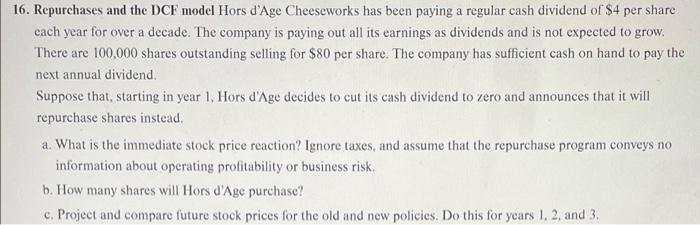

Question: 16. Repurchases and the DCF model Hors d'Age Cheeseworks has been paying a regular cash dividend of $4 per share cach year for over a

16. Repurchases and the DCF model Hors d'Age Cheeseworks has been paying a regular cash dividend of $4 per share cach year for over a decade. The company is paying out all its earnings as dividends and is not expected to grow. There are 100,000 shares outstanding selling for $80 per share. The company has sufficient cash on hand to pay the next annual dividend. Suppose that, starting in year 1. Hors d'Age decides to cut its cash dividend to zero and announces that it will repurchase shares instead, a. What is the immediate stock price reaction? Ignore taxes, and assume that the repurchase program conveys no information about operating profitability or business risk. b. How many shares will Hors d'Age purchase? c. Project and compare future stock prices for the old and new policies. Do this for years 1, 2 and 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts