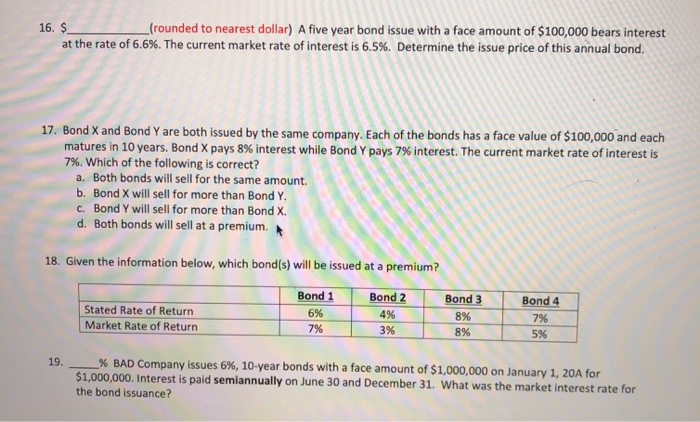

Question: 16. $ (rounded to nearest dollar) A five year bond issue with a face amount of $100,000 bears interest at the rate of 6.6%. The

16. $ (rounded to nearest dollar) A five year bond issue with a face amount of $100,000 bears interest at the rate of 6.6%. The current market rate of interest is 6.5%. Determine the issue price of this annual bond. 17. Bond X and Bond Y are both issued by the same company. Each of the bonds has a face value of $100,000 and each matures in 10 years. Bond X pays 8% interest while Bond Y pays 7% interest. The current market rate of interest is 7%. Which of the following is correct? a. Both bonds will sell for the same amount. b. Bond X will sell for more than Bond Y. C. Bond Y will sell for more than Bond X. d. Both bonds will sell at a premium. 18. Given the information below, which bond(s) will be issued at a premium? Bond 2 Bond 1 6% Stated Rate of Return Market Rate of Return Bond 3 8% 8% Bond 4 7% 5% 79 19. % BAD Company issues 6%, 10-year bonds with a face amount of $1,000,000 on January 1, 20A for $1,000,000. Interest is paid semiannually on June 30 and December 31. What was the market interest rate for the bond issuance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts