Question: 16. This question has two parts. You write a call option with strike price of $50 for $2 and write a put option with a

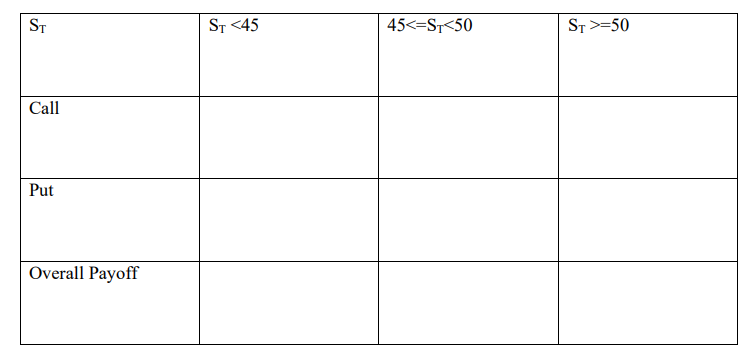

16. This question has two parts. You write a call option with strike price of $50 for $2 and write a put option with a strike price of $45 for $3. Both options are European, have the same time to maturity, and have the same underlying stock. (a) Examine the payoff of this strategy at maturity. What is the payoff when the underlying price is below 45, between 45 and 50, and above 50. Please fill out the empty cells. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts