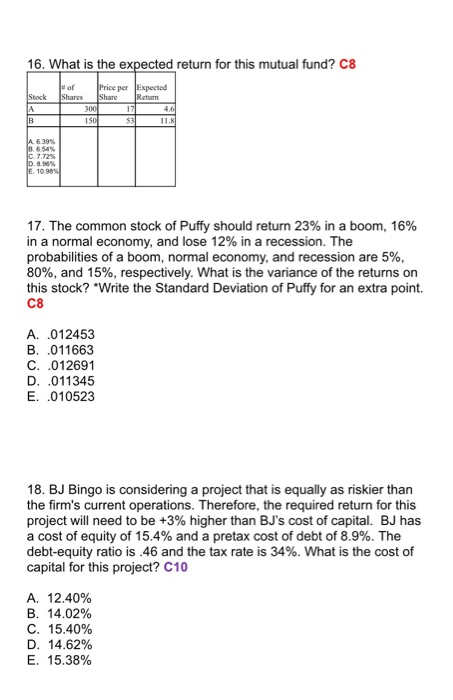

Question: 16. What is the expected return for this mutual fund? C8 Price per Expected 3001 17. The common stock of Puffy should return 23% in

16. What is the expected return for this mutual fund? C8 Price per Expected 3001 17. The common stock of Puffy should return 23% in a boom, 16% in a normal economy, and lose 12% in a recession. The probabilities of a boom, normal economy, and recession are 5%, 80%, and 15%, respectively. What is the variance of the returns on this stock? Write the Standard Deviation of Puffy for an extra point. C8 A..012453 B. .011663 C. .012691 D. .011345 E. .010523 18. BJ Bingo is considering a project that is equally as riskier than the firm's current operations. Therefore, the required return for this project will need to be +3% higher than BJ's cost of capital. BJ has a cost of equity of 15.4% and a pretax cost of debt of 8.9%. The debt-equity ratio is .46 and the tax rate is 34%. What is the cost of capital for this project? C10 A. 12.40% B. 14.02% C. 15.40% D. 14.62% E. 15.38%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts