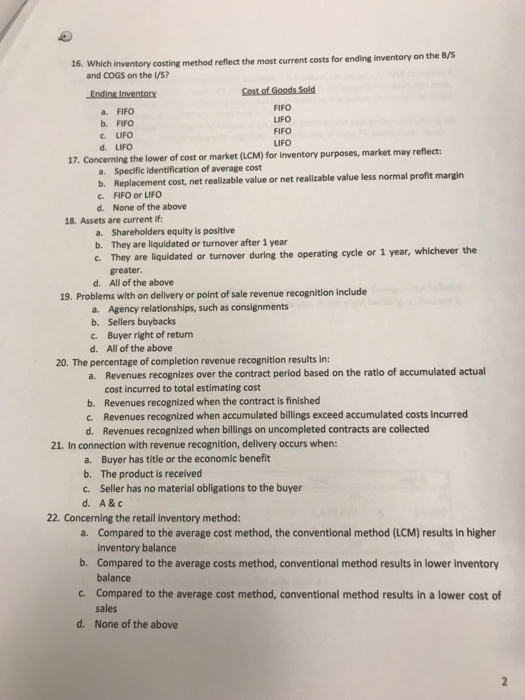

Question: 16. Which inventory costing method reflect the most current costs for ending inventory on the B/S and COGS on the l/S a. FIFO b. FIFO

16. Which inventory costing method reflect the most current costs for ending inventory on the B/S and COGS on the l/S a. FIFO b. FIFO . LIFO d. LIFO FIFO LIFO FIFO LIFO 17. Concerning the lower of cost or market (LCM) for inventory purposes, market may reflect: a. Specific identification of average cost b. Replacement cost, net realizable value or net realizable value less normal profit margin FIFO or LIFO c. d. None of the above 18. Assets are current if a. Shareholders equity is positive b. They are liquidated or turnover after 1 year c. They are liquidated or turnover during the operating cycle or 1 year, whichever the greater d. All of the above 19. Problems with on delivery or point of sale revenue recognition include a. Agency relationships, such as consignments Sellers buybacks b. c. d. Buyer right of return All of the above 20. The percentage of completion revenue recognition results in: a. Revenues recognizes over the contract period based on the ratio of accumulated actual cost incurred to total estimating cost b. Revenues recognized when the contract is finished Revenues recognized when accumulated billings exceed accumulated costs incurred c. d. Revenues recognized when billings on uncompleted contracts are collected 21. In connection with revenue recognition, delivery occurs when: a. b. c. d. Buyer has title or the economic benefit The product is received Seller has no material obligations to the buyer A&C 22. Concerning the retail inventory method: Compared to the average cost method, the conventional method (LCM) results in higher inventory balance a. b. Compared to the average costs method, conventional method results in lower inventory c. Compared to the average cost method, conventional method results in a lower cost f d. None of the above balance sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts