Question: 17) ) 18) 19) 20) 21) 17) The net present value method of capital budgeting implicitly assumes that the cash flows from a project can

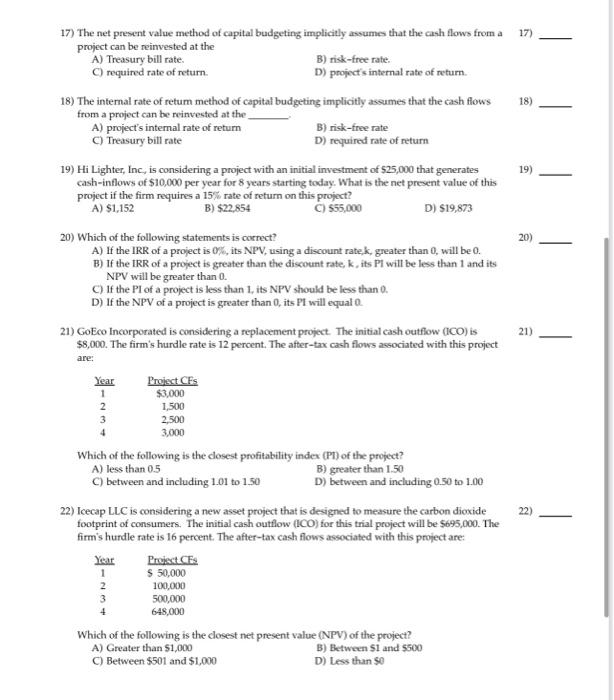

17) ) 18) 19) 20) 21) 17) The net present value method of capital budgeting implicitly assumes that the cash flows from a project can be reinvested at the A) Treasury bill rate. B) risk-free rate. required rate of return D) project's internal rate of return 18) The internal rate of retum method of capital budgeting implicitly assumes that the cash flows from a project can be reinvested at the A) project's internal rate of return B) risk-free rate Treasury bill rate D) required rate of return 19) Hi Lighter, Inc. is considering a project with an initial investment of 525,000 that generates cash-inflows of $10,000 per year for 8 years starting today. What is the net present value of this project if the firm requires a 15% rate of return on this project? A) $1,152 B) $22,854 $55,000 D) $19,873 20) Which of the following statements is correct? A) If the IRR of a project is 0%, its NPV, using a discount ratek, greater than 0, will be 0. B) If the IRR of a project is greater than the discount rate, k,its Pi will be less than 1 and its NPV will be greater than 0. C) If the PI of a project is less than 1, its NPV should be less than 0. D) If the NPV of a project is greater than 0 its Pi will equal o PT 21) GoEco Incorporated is considering a replacement project. The initial cash outflow (ICO) is $8,000. The firm's hurdle rate is 12 percent. The after-tax cash flows associated with this project are: Year Project CFS 1 $3,000 2 1,500 2,500 3,000 Which of the following is the closest profitability index (PT) of the project? A) less than 0.5 B) greater than 1.50 C) between and including 1.01 to 1.50 D) between and including 0.50 to 1.00 22) Icecap LLC is considering a new asset project that is designed to measure the carbon dioxide footprint of consumers. The initial cash outflow (ICO) for this trial project will be $695,000. The firm's hurdle rate is 16 percent. The after-tax cash flows associated with this project are: Year Project.CES $ 50,000 2 100,000 3 500,000 648,000 Which of the following is the closest net present value (NPV) of the project? B) Between S1 and $500 Between $501 and $1,000 D) Less than 50 3 22) 1 A) Greater than $1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts