Question: 17. A company all equity financed whose beta is 1.5. If the expected return on the market portfolio is 10% and the asset without risk

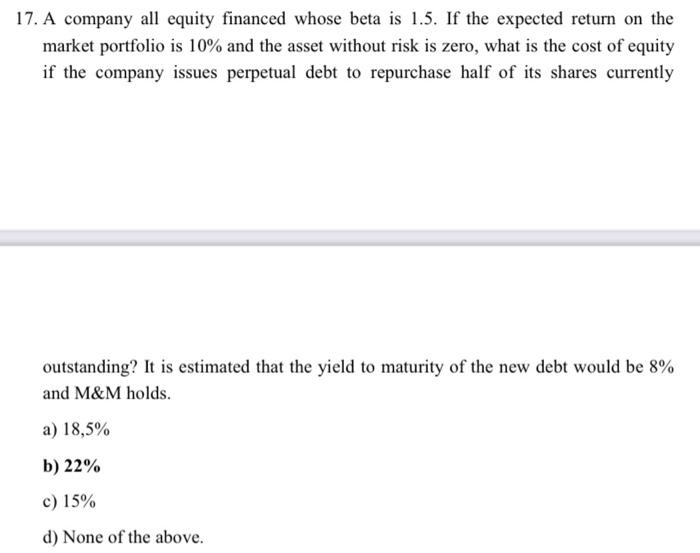

17. A company all equity financed whose beta is 1.5. If the expected return on the market portfolio is 10% and the asset without risk is zero, what is the cost of equity if the company issues perpetual debt to repurchase half of its shares currently outstanding? It is estimated that the yield to maturity of the new debt would be 8% and M&M holds. a) 18,5% b) 22% c) 15% d) None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock