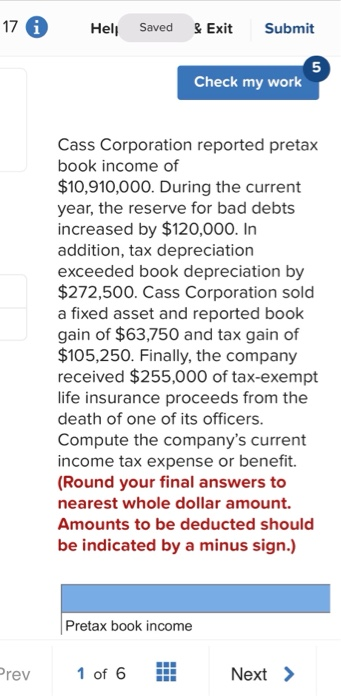

Question: 17 a Heli Saved Exit Submit 5 Check my work Cass Corporation reported pretax book income of $10,910,000. During the current year, the reserve for

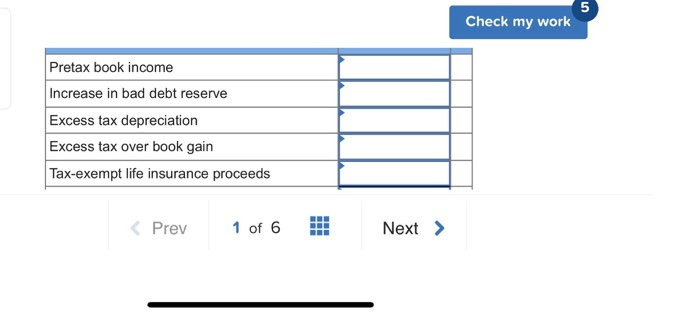

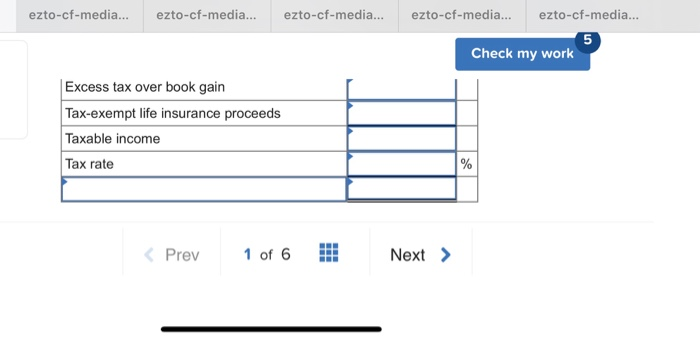

17 a Heli Saved Exit Submit 5 Check my work Cass Corporation reported pretax book income of $10,910,000. During the current year, the reserve for bad debts increased by $120,000. In addition, tax depreciation exceeded book depreciation by $272,500. Cass Corporation sold a fixed asset and reported book gain of $63,750 and tax gain of $105,250. Finally, the company received $255,000 of tax-exempt life insurance proceeds from the death of one of its officers. Compute the company's current income tax expense or benefit. (Round your final answers to nearest whole dollar amount. Amounts to be deducted should be indicated by a minus sign.) Pretax book income Prev 1 of 6 Next > 5 Check my work Pretax book income Increase in bad debt reserve Excess tax depreciation Excess tax over book gain Tax-exempt life insurance proceeds ezto-cf-media... ezto-cf-media... ezto-cf-media... ezto-cf-media... ezto-cf-media... 5 Check my work Excess tax over book gain Tax-exempt life insurance proceeds Taxable income Tax rate %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts