Question: 17! i need the CORRECT answer asap! I will give a thumbs up! Pleaseee! The management of Kimco is evaluating replacing their large mainframe computer

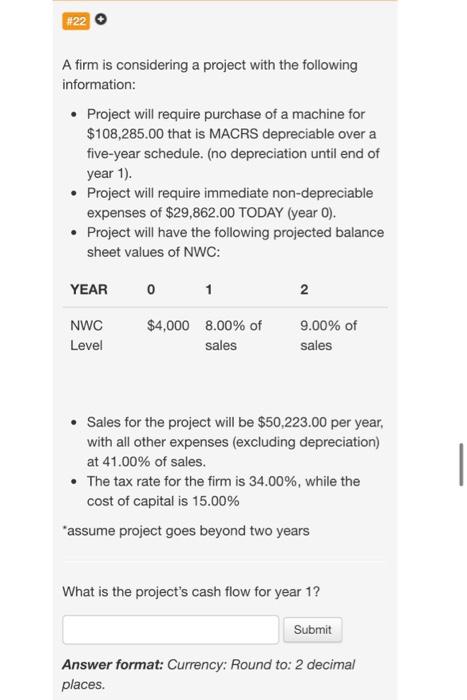

The management of Kimco is evaluating replacing their large mainframe computer with a modern network system that requires much less office space. The network would cost $484,214.00 (including installation costs) and due to efficiency gains, would generate $123,647.00 per year in operating cash flows (accounting for taxes and depreciation) over the next five years. The old mainframe has a remaining book value of $42,604.00 and would be immediately donated to a charity for the tax benefit. Kimco's cost of capital is 11.00% and the tax rate is 37.00%. What is the NPV for this project? Answer format: Currency: Round to: 2 decimal places. A firm is considering a project with the following information: - Project will require purchase of a machine for $108,285.00 that is MACRS depreciable over a five-year schedule. (no depreciation until end of year 1). - Project will require immediate non-depreciable expenses of $29,862.00 TODAY (year 0). - Project will have the following projected balance sheet values of NWC: - Sales for the project will be $50,223.00 per year, with all other expenses (excluding depreciation) at 41.00% of sales. - The tax rate for the firm is 34.00%, while the cost of capital is 15.00% "assume project goes beyond two years What is the project's cash flow for year 1 ? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts