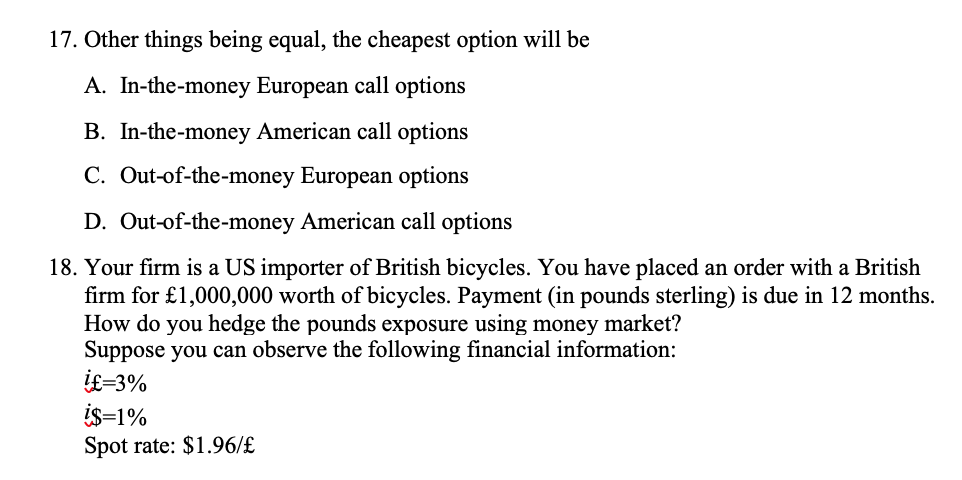

Question: 17. Other things being equal, the cheapest option will be A. In-the-money European call options B. In-the-money American call options C. Out-of-the-money European options D.

17. Other things being equal, the cheapest option will be A. In-the-money European call options B. In-the-money American call options C. Out-of-the-money European options D. Out-of-the-money American call options 18. Your firm is a US importer of British bicycles. You have placed an order with a British firm for 1,000,000 worth of bicycles. Payment (in pounds sterling) is due in 12 months. How do you hedge the pounds exposure using money market? Suppose you can observe the following financial information: i=3% i$=1% Spot rate: $1.96/

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts