Question: 17. Problem 11.35 (Forward versus Option Hedge) Algo eBook As treasurer of Tempe Corp., you are confronted with the following problem. Assume the one-year forward

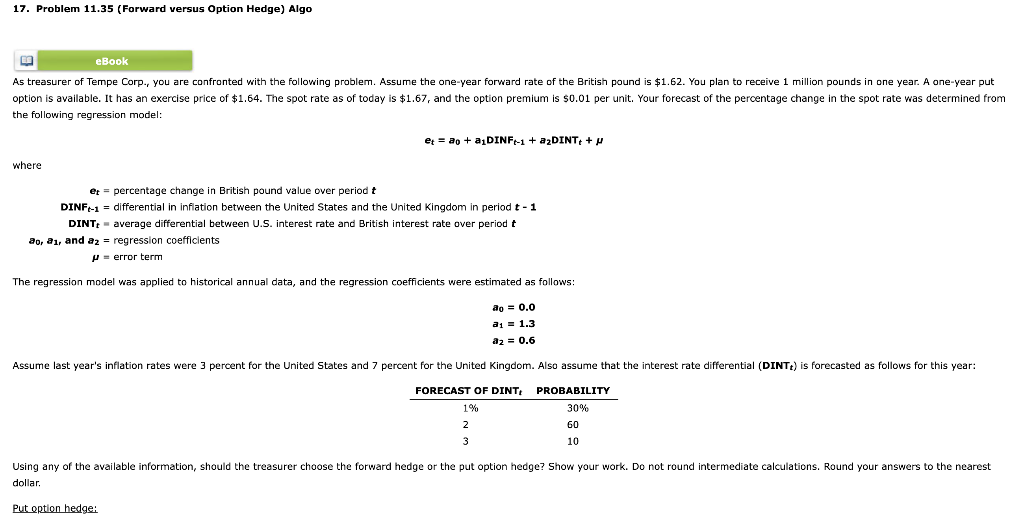

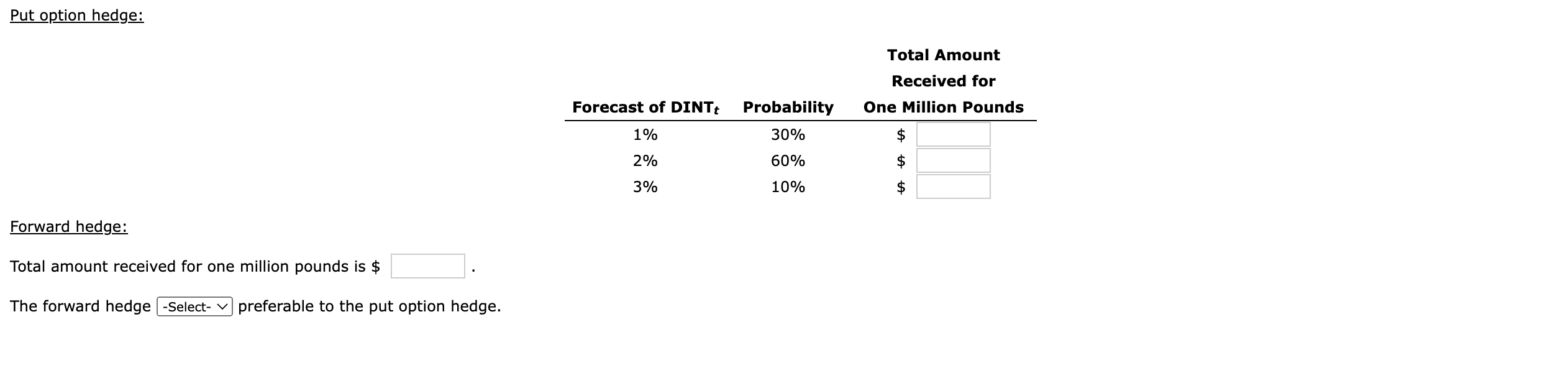

17. Problem 11.35 (Forward versus Option Hedge) Algo eBook As treasurer of Tempe Corp., you are confronted with the following problem. Assume the one-year forward rate of the British pound is $1.62. You plan to receive 1 million pounds in one year. A one-year put option available. It has an exercise price of $1.64. The spot rate as of today $1.67, and option premium is $0.01 per unit. Your forecast of the percentage change in the spot rate was determined from the following regression model: et = ao + a DINF:-1 + a2DINT + where et = percentage change in British pound value over period t DINF-1 = differential in inflation between the United States and the United Kingdom in period t - 1 DINT - average differential between U.S. interest rate and British interest rate over period t ao, ai, and az = regression coefficients Perror term The regression model was applied to historical annual data, and the regression coefficients were estimated as follows: ao = 0.0 a1 = 1.3 a2 = 0.6 Assume last year's inflation rates were 3 percent for the United States and 7 percent for the United Kingdom. Also assume that the interest rate differential (DINTt) is forecasted as follows for this year: FORECAST OF DINT 1% 2 3 PROBABILITY 30% 60 10 the nearest Using any of the available information, should the treasurer choose the forward hedge or the put option hedge? Show your work. Do not round intermediate calculations. Round your answers dollar. Put option hedge: Put option hedge: Total Amount Received for Forecast of DINTE Probability One Million Pounds 1% 30% 2% 60% 3% 10% Forward hedge: Total amount received for one million pounds is $ The forward hedge -Select- v preferable to the put option hedge. 17. Problem 11.35 (Forward versus Option Hedge) Algo eBook As treasurer of Tempe Corp., you are confronted with the following problem. Assume the one-year forward rate of the British pound is $1.62. You plan to receive 1 million pounds in one year. A one-year put option available. It has an exercise price of $1.64. The spot rate as of today $1.67, and option premium is $0.01 per unit. Your forecast of the percentage change in the spot rate was determined from the following regression model: et = ao + a DINF:-1 + a2DINT + where et = percentage change in British pound value over period t DINF-1 = differential in inflation between the United States and the United Kingdom in period t - 1 DINT - average differential between U.S. interest rate and British interest rate over period t ao, ai, and az = regression coefficients Perror term The regression model was applied to historical annual data, and the regression coefficients were estimated as follows: ao = 0.0 a1 = 1.3 a2 = 0.6 Assume last year's inflation rates were 3 percent for the United States and 7 percent for the United Kingdom. Also assume that the interest rate differential (DINTt) is forecasted as follows for this year: FORECAST OF DINT 1% 2 3 PROBABILITY 30% 60 10 the nearest Using any of the available information, should the treasurer choose the forward hedge or the put option hedge? Show your work. Do not round intermediate calculations. Round your answers dollar. Put option hedge: Put option hedge: Total Amount Received for Forecast of DINTE Probability One Million Pounds 1% 30% 2% 60% 3% 10% Forward hedge: Total amount received for one million pounds is $ The forward hedge -Select- v preferable to the put option hedge

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts