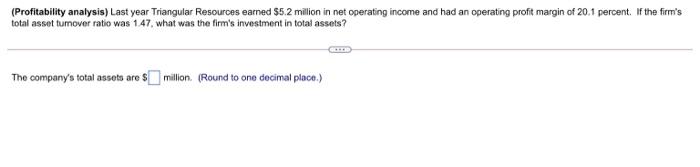

Question: 17 (Profitability analysis) Last year Triangular Resources earned $5.2 million in net operating income and had an operating profit margin of 20.1 percent. If the

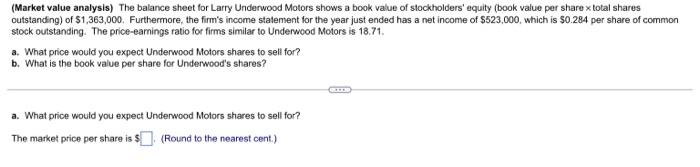

(Profitability analysis) Last year Triangular Resources earned $5.2 million in net operating income and had an operating profit margin of 20.1 percent. If the firm's total asset tumover ratio was 147, what was the firm's investment in total assets? CH The company's total assets are $ million (Round to one decimal place.) (Market value analysis) The balance sheet for Larry Underwood Motors shows a book value of stockholders' equity (book value per share x total shares outstanding) of S1,363,000. Furthermore, the firm's income statement for the year just ended has a net income of $523,000, which is $0.284 per share of common stock outstanding. The price-earnings ratio for firms similar to Underwood Motors is 18.71. a. What price would you expect Underwood Motors shares to sell for? b. What is the book value per share for Underwood's shares? a. What price would you expect Underwood Motors shares to sell for? The market price per share is $. (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts