Question: 17. Suppose you made a 90 -day investment with a maturity value of $15,000. Find the present value of the note if money is worth

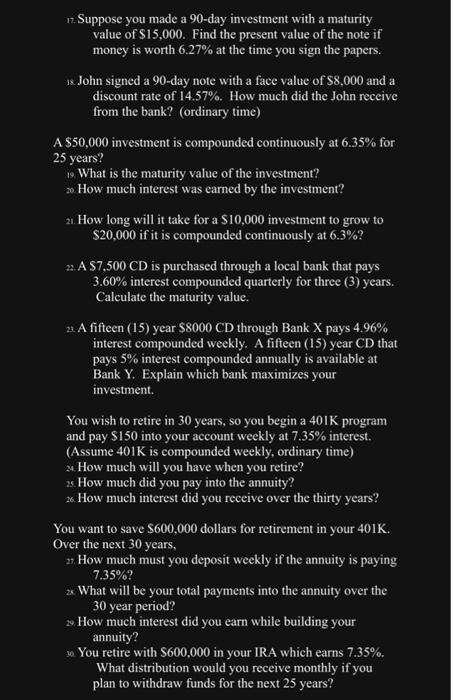

17. Suppose you made a 90 -day investment with a maturity value of $15,000. Find the present value of the note if money is worth 6.27% at the time you sign the papers. 18. John signed a 90-day note with a face value of $8,000 and a discount rate of 14.57%. How much did the John receive from the bank? (ordinary time) A $50,000 investment is compounded continuously at 6.35% for 25 years? 19. What is the maturity value of the investment? so How much interest was earned by the investment? 21. How long will it take for a $10,000 investment to grow to $20,000 if it is compounded continuously at 6.3% ? 22. A $7,500CD is purchased through a local bank that pays 3.60% interest compounded quarterly for three (3) years. Calculate the maturity value. 22. A fifteen (15) year $8000 CD through Bank X pays 4.96% interest compounded weekly. A fifteen (15) year CD that pays 5% interest compounded annually is available at Bank Y. Explain which bank maximizes your investment. You wish to retire in 30 years, so you begin a 401K program and pay $150 into your account weekly at 7.35% interest. (Assume 401K is compounded weekly, ordinary time) 24. How much will you have when you retire? s. How much did you pay into the annuity? 26. How much interest did you receive over the thirty years? You want to save $600,000 dollars for retirement in your 401K. Over the next 30 years, 27. How much must you deposit weekly if the annuity is paying 7.35% ? 2x. What will be your total payments into the annuity over the 30 year period? 2. How much interest did you earn while building your annuity? 30. You retire with $600,000 in your IRA which earns 7.35%. What distribution would you receive monthly if you plan to withdraw funds for the next 25 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts