Question: 17. The closing entry for expenses includes: A. A debit to Dividends and a credit to all expense accounts. B. A debit to Retained

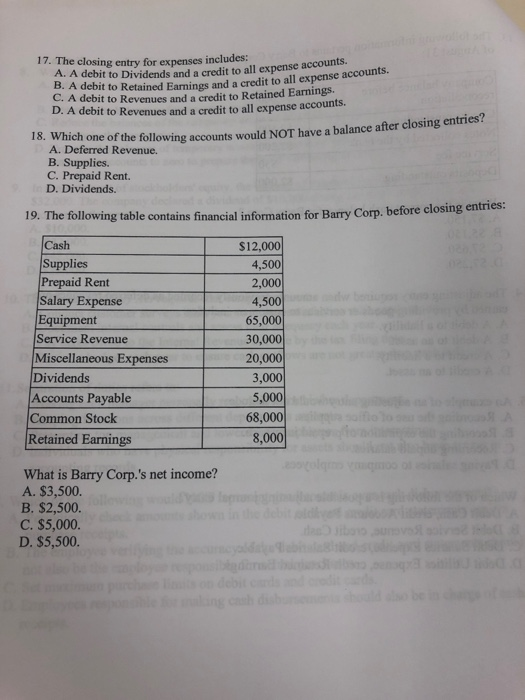

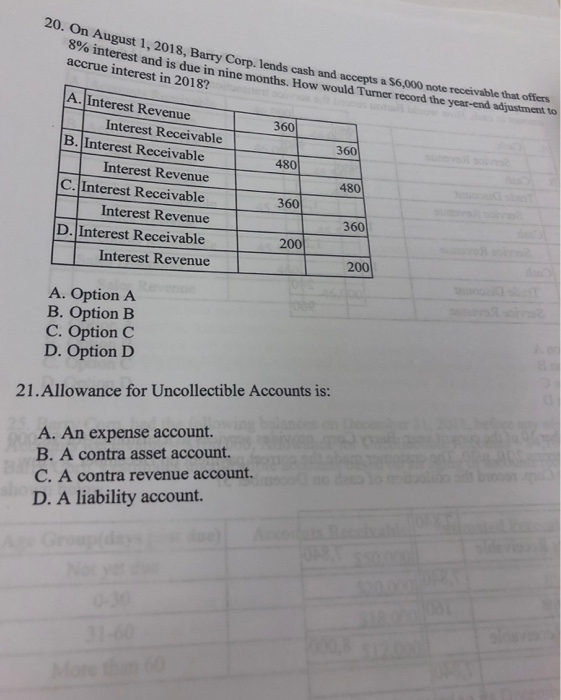

17. The closing entry for expenses includes: A. A debit to Dividends and a credit to all expense accounts. B. A debit to Retained Earnings and a credit to all expense accounts. C. A debit to Revenues and a credit to Retained Earnings. D. A debit to Revenues and a credit to all expense accounts. 18. Which one of the following accounts would NOT have a balance after closing entries? A. Deferred Revenue. B. Supplies. C. Prepaid Rent. In D. Dividends. 19. The following table contains financial information for Barry Corp. before closing entries: Cash Supplies Prepaid Rent Salary Expense Equipment Service Revenue Miscellaneous Expenses Dividends Accounts Payable Common Stock Retained Earnings What is Barry Corp.'s net income? A. $3,500. B. $2,500. C. $5,000. D. $5,500. $12,000 4,500 2,000 4,500 65,000 30,000 20,000 3,000 5,000 68,000 8,000 Ieproningin das sibovo 20. On August 1, 2018, Barry Corp. lends cash and accepts a $6,000 note receivable that offers 8% interest and is due in nine months. How would Turner record the year-end adjustment to accrue interest in 2018? A. Interest Revenue Interest Receivable B. Interest Receivable Interest Revenue C. Interest Receivable Interest Revenue D. Interest Receivable Interest Revenue A. An expense account. B. A contra asset account. C. A contra revenue account. D. A liability account. 360 Age Group(days 480 360 A. Option A B. Option B C. Option C D. Option D 21. Allowance for Uncollectible Accounts is: 200 360 480 360 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts