Question: 17. When using multifactor comparisons in a capital budgeting analysis, which method should the greatest emphasis be placed on: a. Payback b. Net Present Value

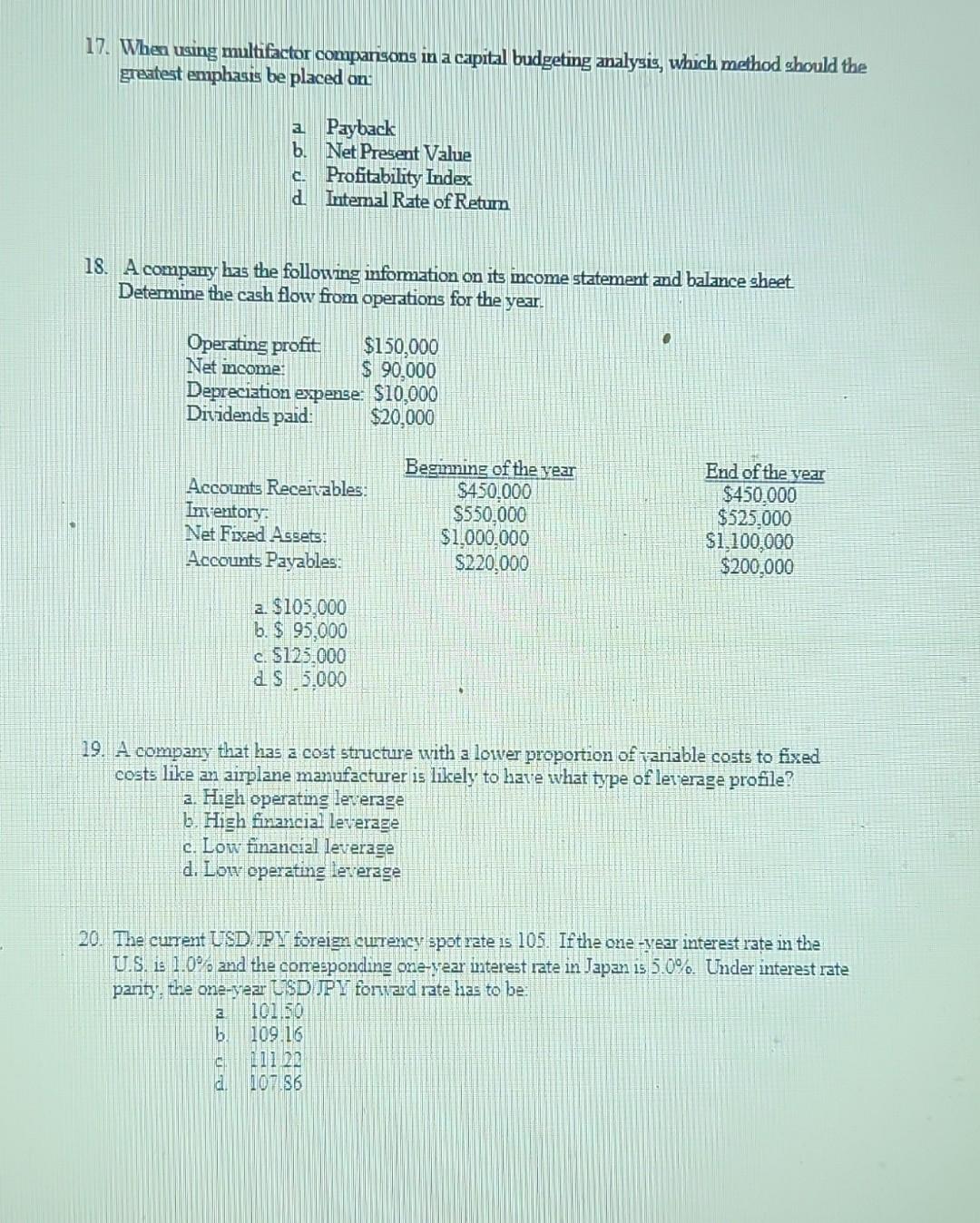

17. When using multifactor comparisons in a capital budgeting analysis, which method should the greatest emphasis be placed on: a. Payback b. Net Present Value c. Profitability Index d. Intemal Rate of Retum 18. A compary has the following information on its income statement and balance sheet. Determine the cash flow from operations for the year. b. $95,000 c. $125,000 d S 5,000 19. A company that has a cost structure with a lower proportion of iariable costs to fixed costs like an airplane manufacturer is likely to have what type of leverage profile? a. High operating leverage b. High financial leverage c. Low financial leverage d. Low operating leverage 20. The current USD. .PI foreign currency spot rate is 105 . If the one -vear interest rate in the U.S. is 1.0% and the corresponding one-year interest rate in Japan is 5.0%. Under interest rate parity; the one-year USD JPY forward rate has to be: 3. 101.50 b. 109.16 c. 211022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts