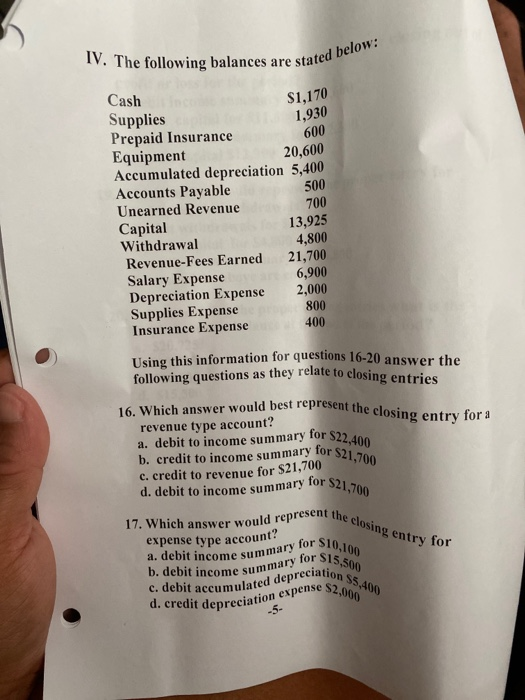

Question: 17. Which answer would represent the closing entry for d. credit depreciation expense $2,000 $1,170 1,930 600 500 IV. The following balances are stated below:

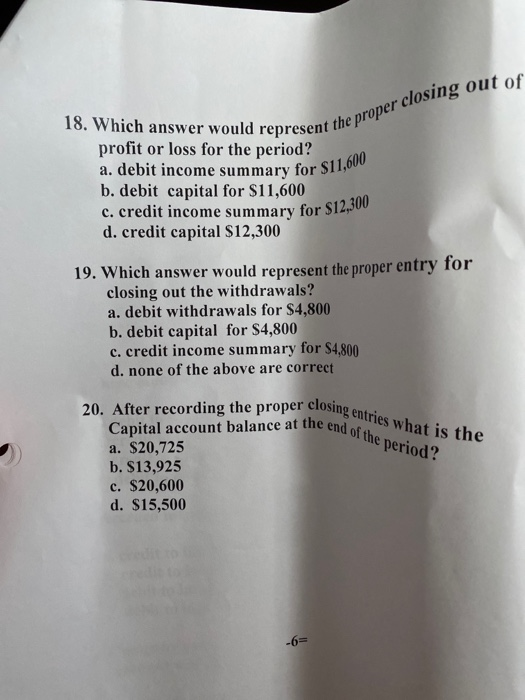

17. Which answer would represent the closing entry for d. credit depreciation expense $2,000 $1,170 1,930 600 500 IV. The following balances are stated below: b. credit to income summary for $21,700 b. debit income summary for $15,500 c. debit accumulated depreciations Cash Supplies Prepaid Insurance Equipment 20,600 Accumulated depreciation 5,400 Accounts Payable Unearned Revenue 700 Capital Withdrawal 4,800 Revenue-Fees Earned 21,700 Salary Expense 6,900 Depreciation Expense 2,000 Supplies Expense 800 Insurance Expense 400 Using this information for questions 16-20 answer the following questions as they relate to closing entries 16. Which answer would est represent the closing entry for a revenue type account? a. debit to income summary 13,925 for S22,400 c. credit to revenue for $21,700 d. debit to income summary for $21,700 for $10,100 expense type account? a. debit income summary S5.400 t the proper closing out of a. debit income summary for $11.600 c. credit income summary for $12,300 Capital account balance at the end of the period? 18. Which answer would represent profit or loss for the period? b. debit capital for $11,600 d. credit capital $12,300 19. Which answer would represent the proper entry for closing out the withdrawals? a. debit withdrawals for $4,800 b. debit capital for $4,800 c. credit income summary for $4,800 d. none of the above are correct 20. After recording the proper closing entries what is the a. $20,725 b. $13,925 c. $20,600 d. $15,500 -6=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts