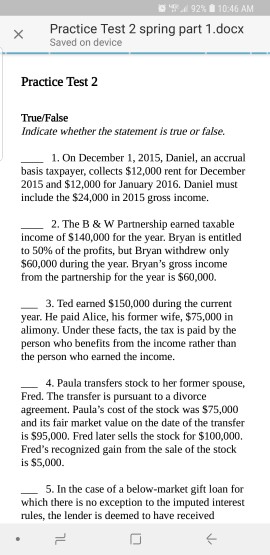

Question: 17.d g24 10:46 AM Practice Test 2 spring part 1.docx Saved on device Practice Test 2 True/False Indicate whether the statement is true or false.

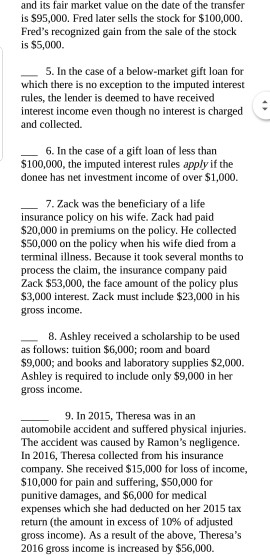

17.d g24 10:46 AM Practice Test 2 spring part 1.docx Saved on device Practice Test 2 True/False Indicate whether the statement is true or false. --1. On December 1, 2015, Daniel, an accrual basis taxpayer, collects $12,000 rent for December 2015 and $12,000 for January 2016. Daniel must include the $24,000 in 2015 gross income. 2. The B & W Partnership earned taxable income of S140,000 for the year. Bryan is entitled to 50% of the profits, but Bryan withdrew only $60,000 during the year. Bryan's gross income from the partnership for the year is $60,000. 3. Ted earned $150,000 during the current year. He paid Alice, his former wife, $75,000 in alimony. Under these facts, the tax is paid by the person who benefits from the income rather than the person who earned the income. -4. Paula transfers stock to her former spouse, Fred. The transfer is pursuant to a divorce agreement. Paula's cost of the stock was $75,000 and its fair market value on the date of the transfer is $95,000, Fred later sells the stock for $100,000. Fred's recognized gain from the sale of the stock is $5,000 5. In the case of a below-market gift loan for which there is no exception to the imputed interest rules, the lender is deemed to have received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts