Question: 18 & 19 (Joint Cost Allocation Physical Units Method) Blake's Blacksmith Co, produces two types of shotguns, a 12-gauge and 20-gauge. The shotguns are made

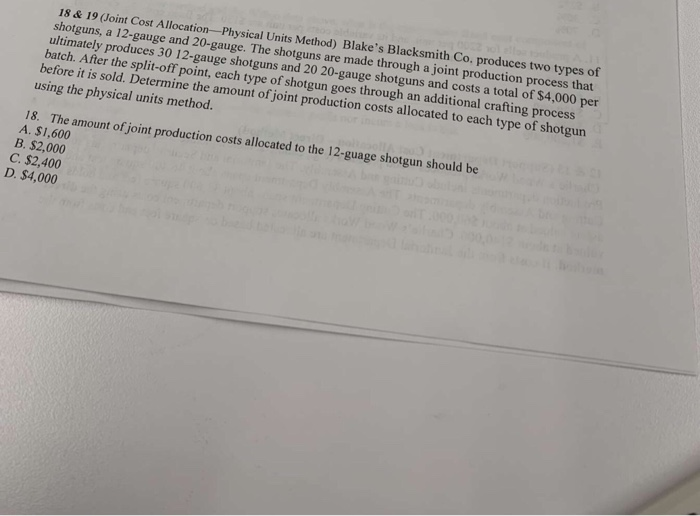

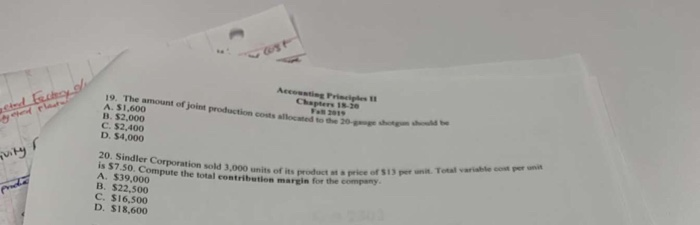

18 & 19 (Joint Cost Allocation Physical Units Method) Blake's Blacksmith Co, produces two types of shotguns, a 12-gauge and 20-gauge. The shotguns are made through a joint production process that ultimately produces 30 12-gauge shotguns and 20 20-gauge shotguns and costs a total of $4.000 per batch. After the split-off point, each type of shotgun goes through an additional crafting process before it is sold. Determine the amount of joint production costs allocated to each type of shotgun using the physical units method. 18. The amount of joint production costs allocated to the 12-guage shotgun should be A. $1,600 B. $2,000 C. $2,400 D. $4,000 perfecta Accent Price Chapter 10 19. The amount of joint production costs allowed to the 20- A. 51.600 B. $2,000 C. $2.400 D. $4,000 to the 20- eshehehe units of its product s Total vare per 20. Sindler Corporation sold 3.000 units of its pro 1857-50. Compute the total contributie margin for the company A. $19.000 B. $22,500 C. $16,500 D. $18.600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts