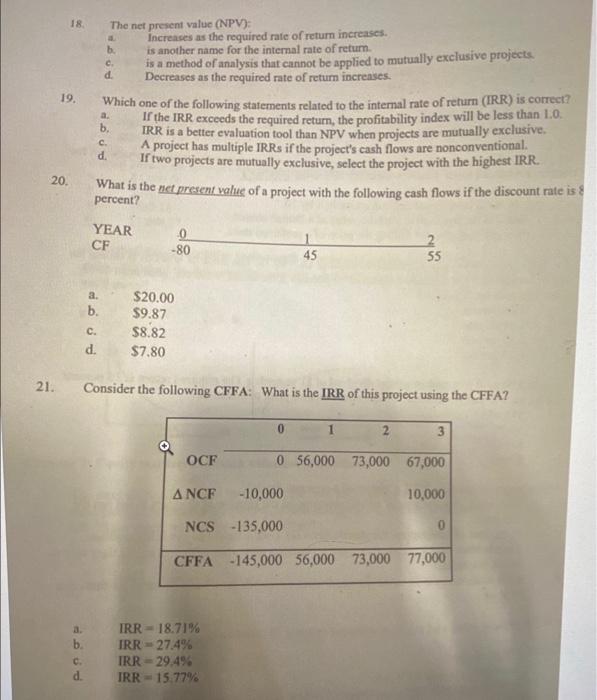

Question: 18 19. The net present value (NPV): Increases as the required rate of return increases. b. is another name for the internal rate of return

18 19. The net present value (NPV): Increases as the required rate of return increases. b. is another name for the internal rate of return c is a method of analysis that cannot be applied to mutually exclusive projects d. Decreases as the required rate of return increases. Which one of the following statements related to the internal rate of return (IRR) is correct? If the IRR exceeds the required return, the profitability index will be less than 10. 1p b IRR is a better evaluation tool than NPV when projects are mutually exclusive. A project has multiple IRRs if the project's cash flows are nonconventional. If two projects are mutually exclusive, select the project with the highest IRR. What is the net present value of a project with the following cash flows if the discount rate is percent? a CP C d. 20. YEAR CF -80 45 55 a. b. $20.00 $9.87 $8.82 $7.80 c. d. 21. Consider the following CFFA: What is the IRR of this project using the CFFA? 0 1 2 3 OCF 0 56,000 73,000 67,000 A NCF -10,000 10,000 NCS -135,000 0 CFFA -145,000 56,000 73,000 77,000 a b. IRR - 18.71% IRR 27.4% IRR - 29.4% IRR 15.77% d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts