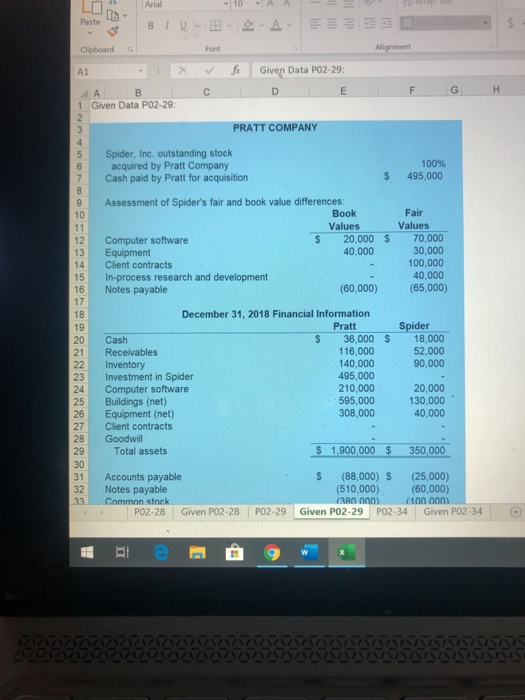

Question: -18 A A Alignment Clipboard A1 X A B 1 Given Data P02-29: f Given Data PO2-29: D E C F G H PRATT COMPANY

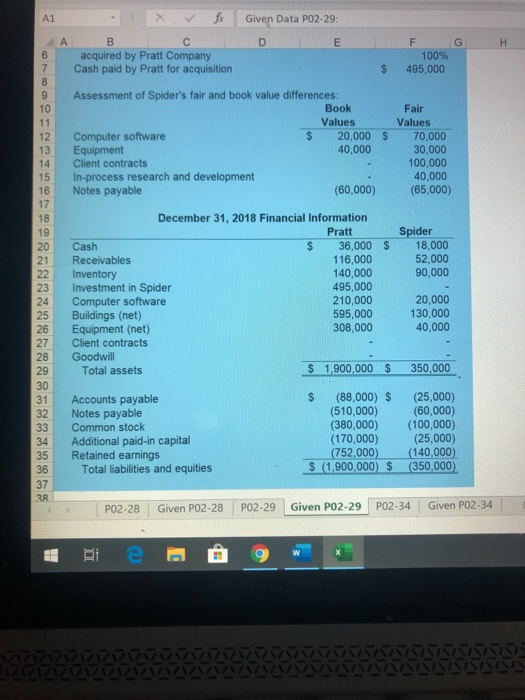

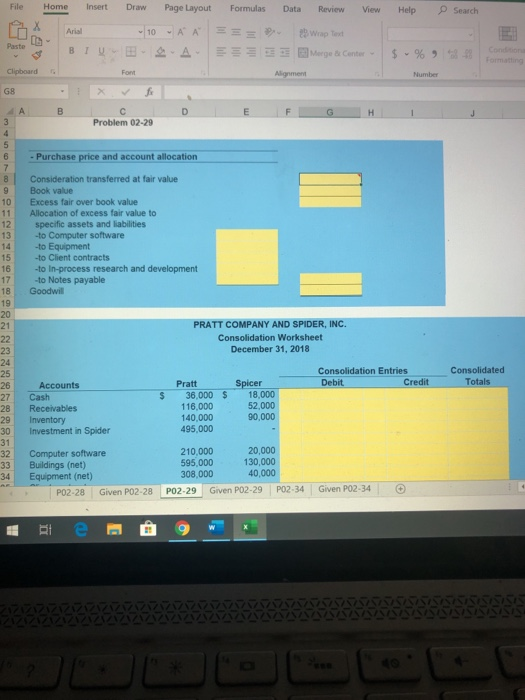

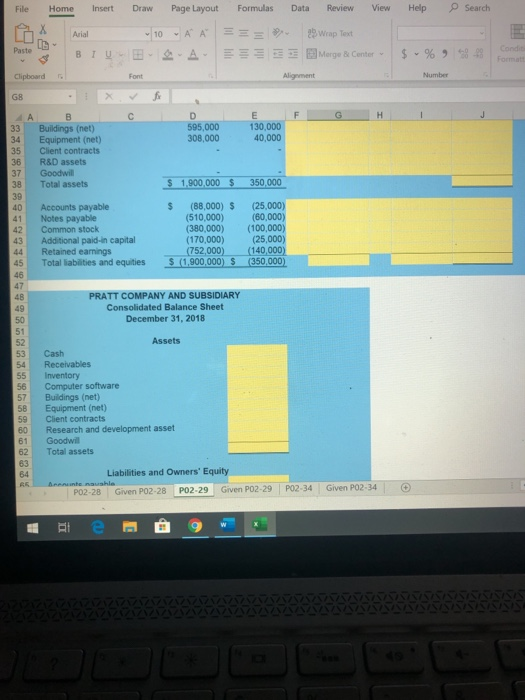

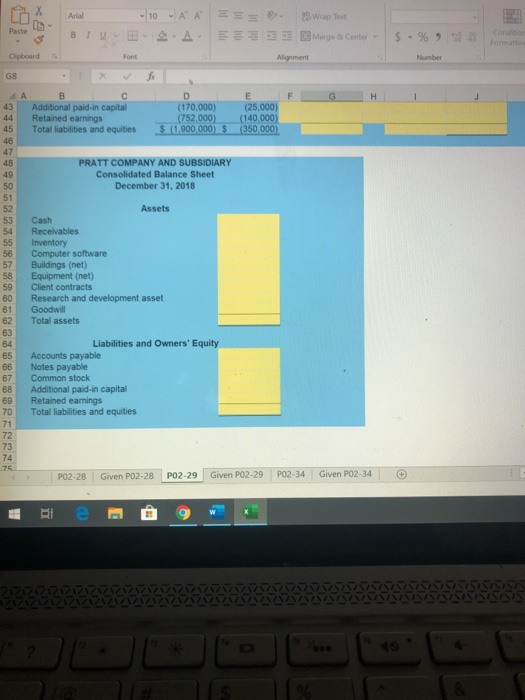

-18 A A Alignment Clipboard A1 X A B 1 Given Data P02-29: f Given Data PO2-29: D E C F G H PRATT COMPANY DO Spider, Inc. outstanding stock acquired by Pratt Company Cash paid by Pratt for acquisition $ 100% 495,000 $ Assessment of Spider's fair and book value differences: Book Values Computer software 20,000 Equipment 40.000 Client contracts In-process research and development Notes payable (60,000) Fair Values 70,000 30,000 100,000 40,000 (65.000) Spider 18,000 52,000 90,000 December 31, 2018 Financial Information Pratt Cash 36,000 $ Receivables 116,000 Inventory 140,000 Investment in Spider 495,000 Computer software 210,000 Buildings (net) 595,000 Equipment (net) 308,000 Client contracts Goodwill Total assets $ 1,900,000 $ 20,000 130,000 40,000 350,000 Accounts payable Notes payable Common stock PO2-28 Given P02-28 $ (88,000) S (25,000) (510,000) (60,000) IRRO 000 100 000 PO2-29 Given PO2-29 PO2-34 Given PO2-34 A1 x f Given Data P02-29: Cash pard by Pratcc acquired by Pratt Company Cash paid by Pratt for acquisition $ 100% 495,000 $ Assessment of Spider's fair and book value differences: Book Values Computer software 20,000 Equipment 40,000 Client contracts In-process research and development Notes payable (60,000) Fair Values 70,000 30,000 100,000 40,000 (65,000) $ Spider 18,000 52,000 90,000 December 31, 2018 Financial Information Pratt Cash 36,000 Receivables 116,000 Inventory 140,000 Investment in Spider 495,000 Computer software 210,000 Buildings (net) 595,000 Equipment (net) 308,000 Client contracts Goodwill Total assets $ 1.900,000 20,000 130,000 40,000 $ 350,000 Accounts payable Notes payable Common stock Additional paid-in capital Retained earnings Total liabilities and equities (88,000) $ (510,000) (380,000) (170,000) (752,000) $ (1,900,000) $ (25,000) (60,000) (100,000) (25,000) (140,000) (350,000) 35 36 PO2-28 Given P02-28 PO2-29 Given P02-29 PO2-34 Given P02-34 File Home Insert Data Help Search Draw 10 Arial B TUB Page Layout Formulas AA === A EE Review View Wrap Text Marge & Center - $ -% -8.8 Conde Clipboard Alignment Number 595.000 308,000 130,000 40,000 AB 33 Buildings (net) Equipment (net) Client contracts R&D assets Goodwill Total assets 36 $ 1.900,000 $ 350,000 Accounts payable Notes payable Common stock Additional paid-in capital Retained earnings Total liabilities and equities $ (88,000) $ (510,000) (380,000) (170,000) (752,000) $ (1,900,000) $ (25,000) (60,000) (100,000) (25,000) (140 000) 350,000) PRATT COMPANY AND SUBSIDIARY Consolidated Balance Sheet December 31, 2018 Assets Cash Receivables Inventory Computer software Buildings (net) Equipment (net) Client contracts Research and development asset Goodwill Total assets Liabilities and Owners' Equity entenaushla PO2-28 Given PO2-28 PO2-29 Given PO2-29 PO2-34 Given P02-34 Paste - Arial BIL 10 A = = = 3 28 Wrap Text Merge & Center - $ -% 18 Clipboard Alignment G8 F G H i 43 44 Additional paid-in capital Retained earnings Total liabilities and equities (170,000) (752,000) 1.900,000 (25,000) (140,000) 350,000) $ $ PRATT COMPANY AND SUBSIDIARY Consolidated Balance Sheet December 31, 2018 Assets Cash Receivables Inventory Computer software Buildings (net) Equipment (net) Client contracts Research and development asset Goodwill Total assets 58 65 Liabilities and Owners' Equity Accounts payable Notes payable Common stock Additional paid-in capital Retained earnings Total liabilities and equities 70 72 PO2-28 Given PO2-28 PO2-29 Given P02-29 PO2-34 Given P02-34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts