Question: 18) A partial payment is made on the date(s) indicated. Use the United States Rule to determine the balance due on the note at the

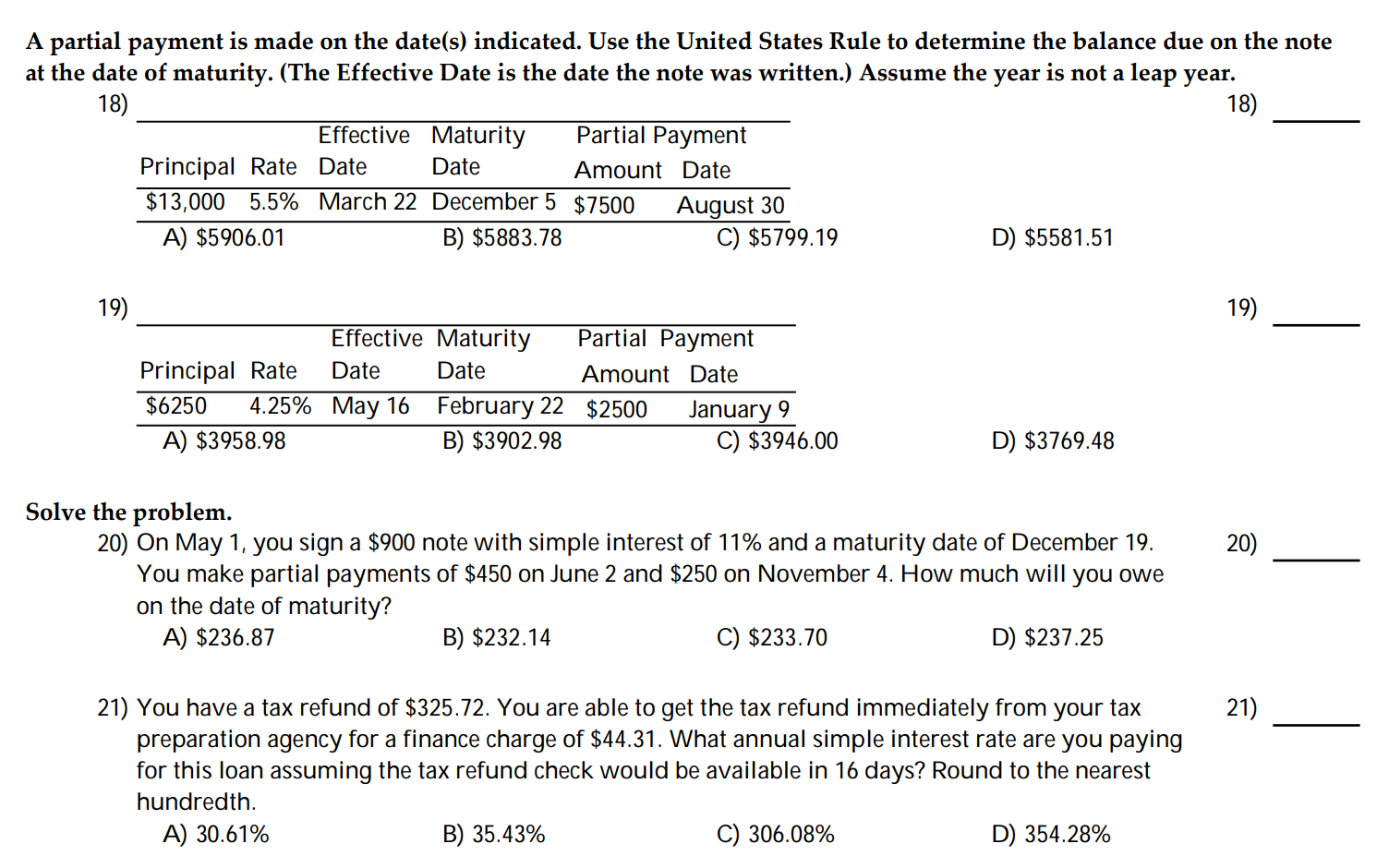

18) A partial payment is made on the date(s) indicated. Use the United States Rule to determine the balance due on the note at the date of maturity. (The Effective Date is the date the note was written.) Assume the year is not a leap year. 18) Effective Maturity Partial Payment Principal Rate Date Date Amount Date $13,000 5.5% March 22 December 5 $7500 August 30 A) $5906.01 B) $5883.78 C) $5799.19 D) $5581.51 19) 19) Effective Maturity Partial Payment Principal Rate Date Date Amount Date $6250 4.25% May 16 February 22 $2500 January 9 A) $3958.98 B) $3902.98 C) $3946.00 D) $3769.48 20) Solve the problem. 20) On May 1, you sign a $900 note with simple interest of 11% and a maturity date of December 19. You make partial payments of $450 on June 2 and $250 on November 4. How much will you owe on the date of maturity? A) $236.87 B) $232.14 C) $233.70 D) $237.25 21) 21) You have a tax refund of $325.72. You are able to get the tax refund immediately from your tax preparation agency for a finance charge of $44.31. What annual simple interest rate are you paying for this loan assuming the tax refund check would be available in 16 days? Round to the nearest hundredth. A) 30.61% B) 35.43% C) 306.08% D) 354.28%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts