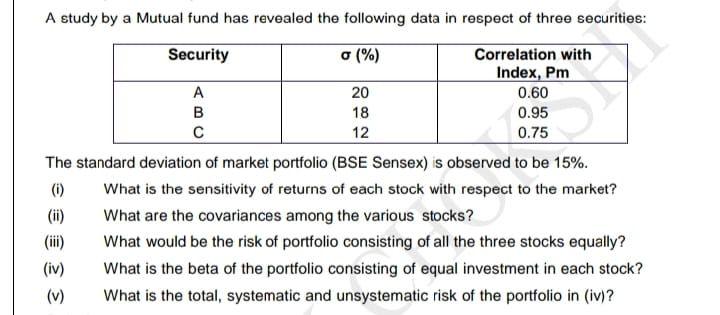

Question: 18 A study by a Mutual fund has revealed the following data in respect of three securities: Security (%) Correlation with Index, Pm A 20

18 A study by a Mutual fund has revealed the following data in respect of three securities: Security (%) Correlation with Index, Pm A 20 0.60 B 0.95 C 12 0.75 The standard deviation of market portfolio (BSE Sensex) is observed to be 15%. (1) What is the sensitivity of returns of each stock with respect to the market? (ii) What are the covariances among the various stocks? What would be the risk of portfolio consisting of all the three stocks equally? (iv) What is the beta of the portfolio consisting of equal investment in each stock? (v) What is the total, systematic and unsystematic risk of the portfolio in (iv)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock