Question: 18 Check my work 8 Problem 8-35 P/E Model and Cash Flow Valuation (LG8-5, LG8-7) Suppose that a firm's recent earnings per share and dividend

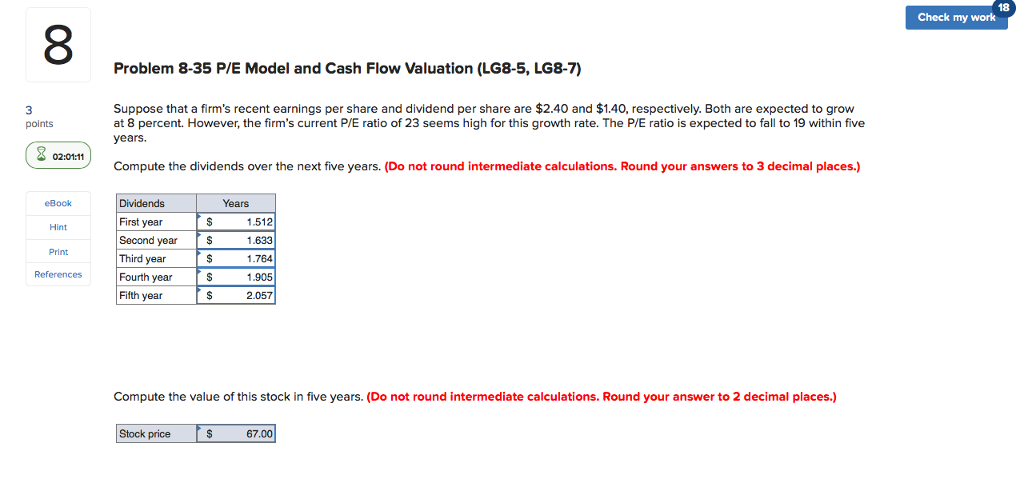

18 Check my work 8 Problem 8-35 P/E Model and Cash Flow Valuation (LG8-5, LG8-7) Suppose that a firm's recent earnings per share and dividend per share are $2.40 and $1.40, respectively. Both are expected to grow at 8 percent. However, the firm's current P/E ratio of 23 seems high for this growth rate. The P/E ratio is expected to fall to 19 within five years. points 02:01:11 Compute the dividends over the next five years. (Do not round intermediate calculations. Round your answers to 3 decimal places.) Dividends First year Second year Third year Fourth year Fifth year eBook Years 1.512 1.633 1.764 1.905 2.057 Hint Print Compute the value of this stock in five years. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Stock price 67.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts