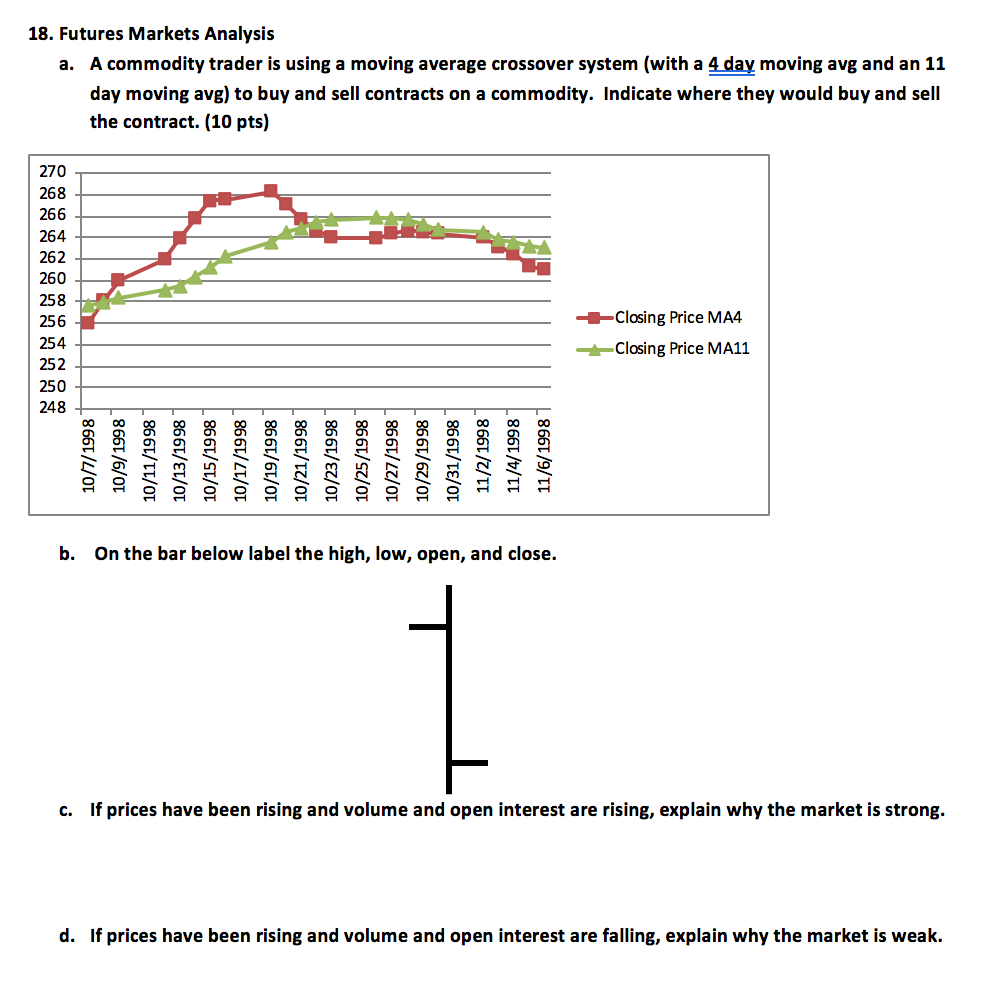

Question: 18. Futures Markets Analysis a. A commodity trader is using a moving average crossover system (with a 4 day moving avg and an 11 day

18. Futures Markets Analysis a. A commodity trader is using a moving average crossover system (with a 4 day moving avg and an 11 day moving avg) to buy and sell contracts on a commodity. Indicate where they would buy and sell the contract. (10 pts) 270 268 oooo +Closing Price MA4 +Closing Price MA11 10/7/1998 10/9/1998 10/11/1998 10/13/1998 10/15/1998 10/17/1998 10/19/1998 10/21/1998 10/23/1998 10/25/1998 10/27/1998 10/29/1998 10/31/1998 11/2/1998 11/4/1998 11/6/19981 b. On the bar below label the high, low, open, and close. c. If prices have been rising and volume and open interest are rising, explain why the market is strong. d. If prices have been rising and volume and open interest are falling, explain why the market is weak. 18. Futures Markets Analysis a. A commodity trader is using a moving average crossover system (with a 4 day moving avg and an 11 day moving avg) to buy and sell contracts on a commodity. Indicate where they would buy and sell the contract. (10 pts) 270 268 oooo +Closing Price MA4 +Closing Price MA11 10/7/1998 10/9/1998 10/11/1998 10/13/1998 10/15/1998 10/17/1998 10/19/1998 10/21/1998 10/23/1998 10/25/1998 10/27/1998 10/29/1998 10/31/1998 11/2/1998 11/4/1998 11/6/19981 b. On the bar below label the high, low, open, and close. c. If prices have been rising and volume and open interest are rising, explain why the market is strong. d. If prices have been rising and volume and open interest are falling, explain why the market is weak

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts