Question: 1.8 Please help me to answer these please with solutions. Thank you so much. 1.8 COMPARISON OF SIMPLE INTEREST AND SIMPLE DISCOUNT A simple interest

1.8

Please help me to answer these please with solutions. Thank you so much.

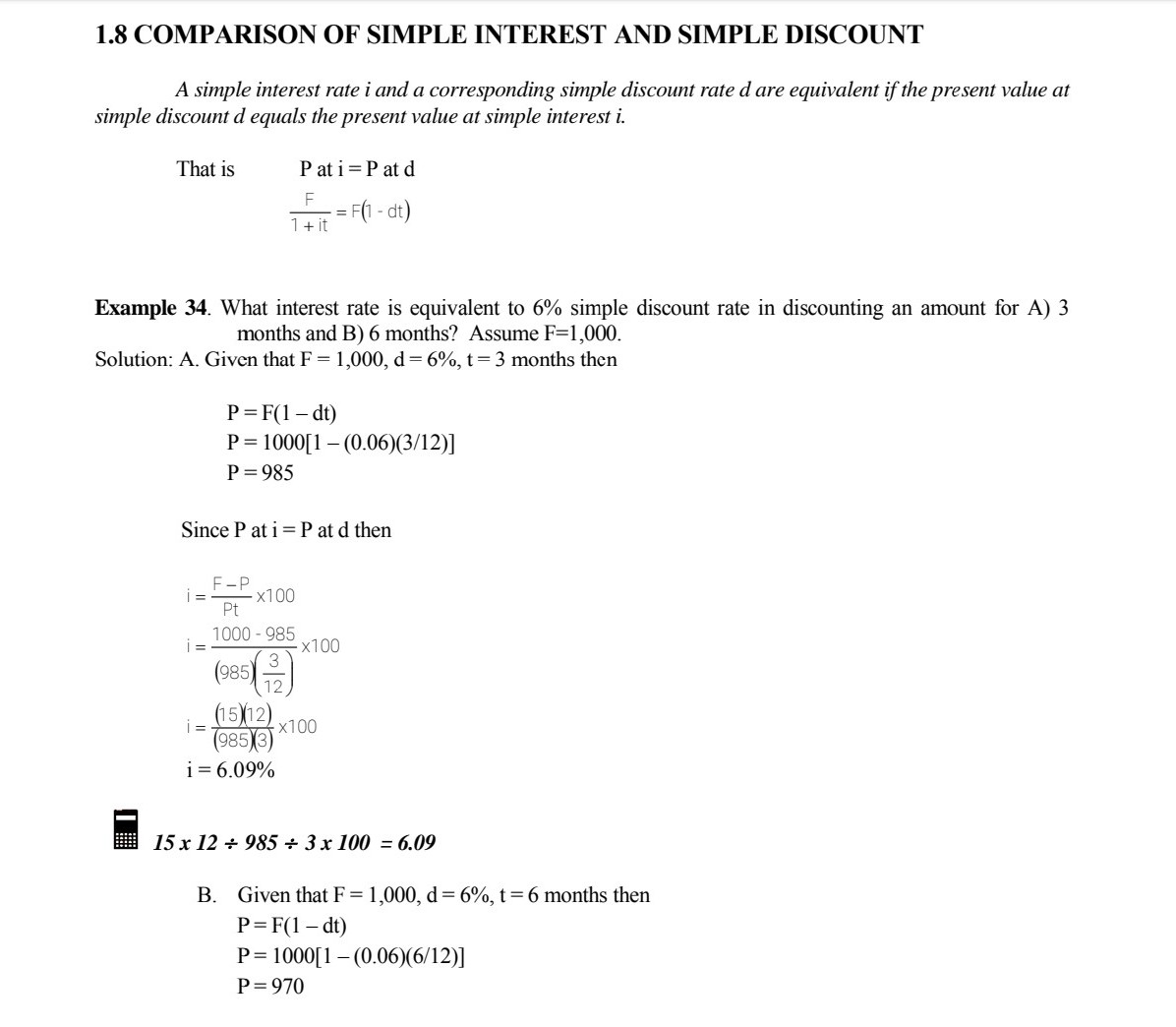

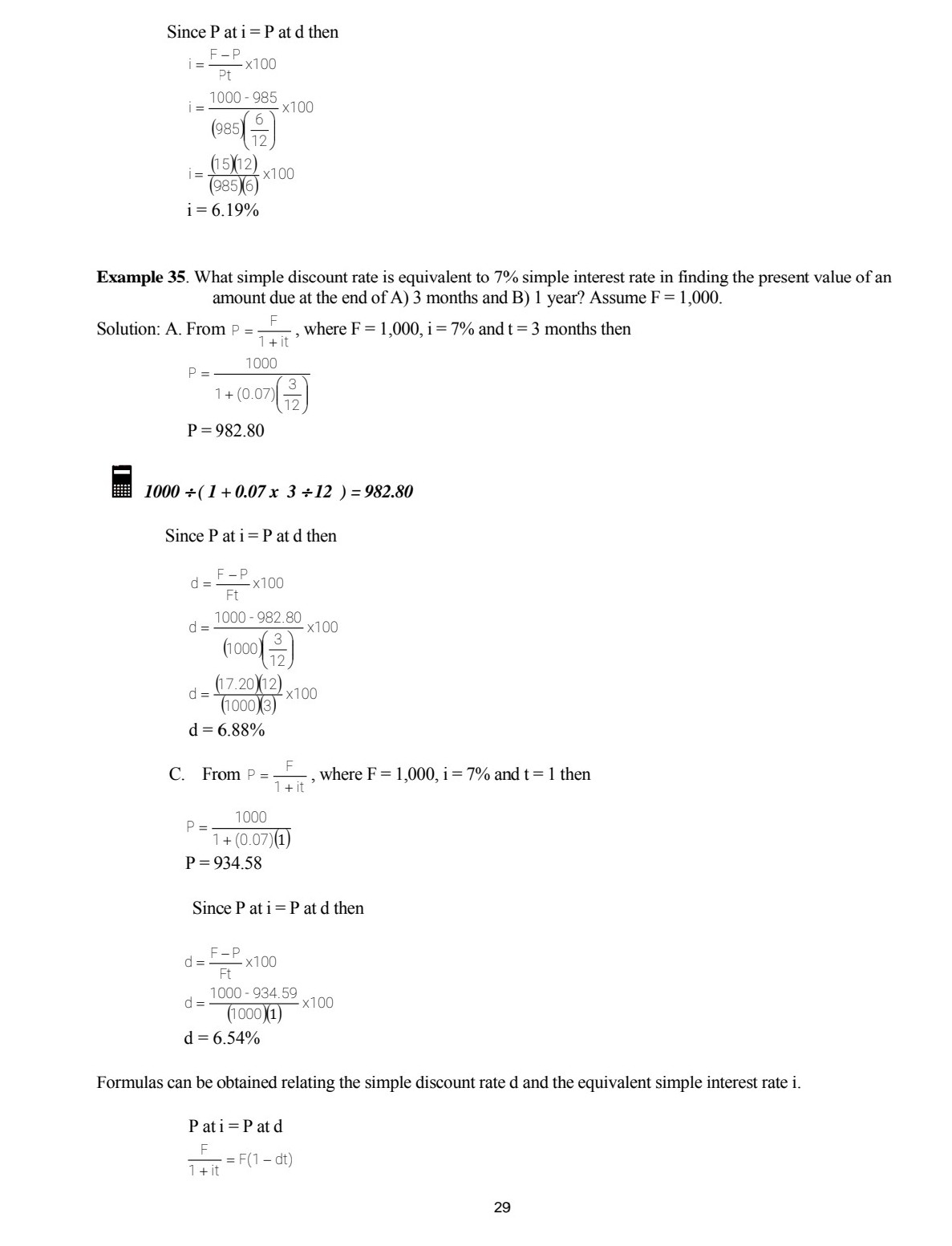

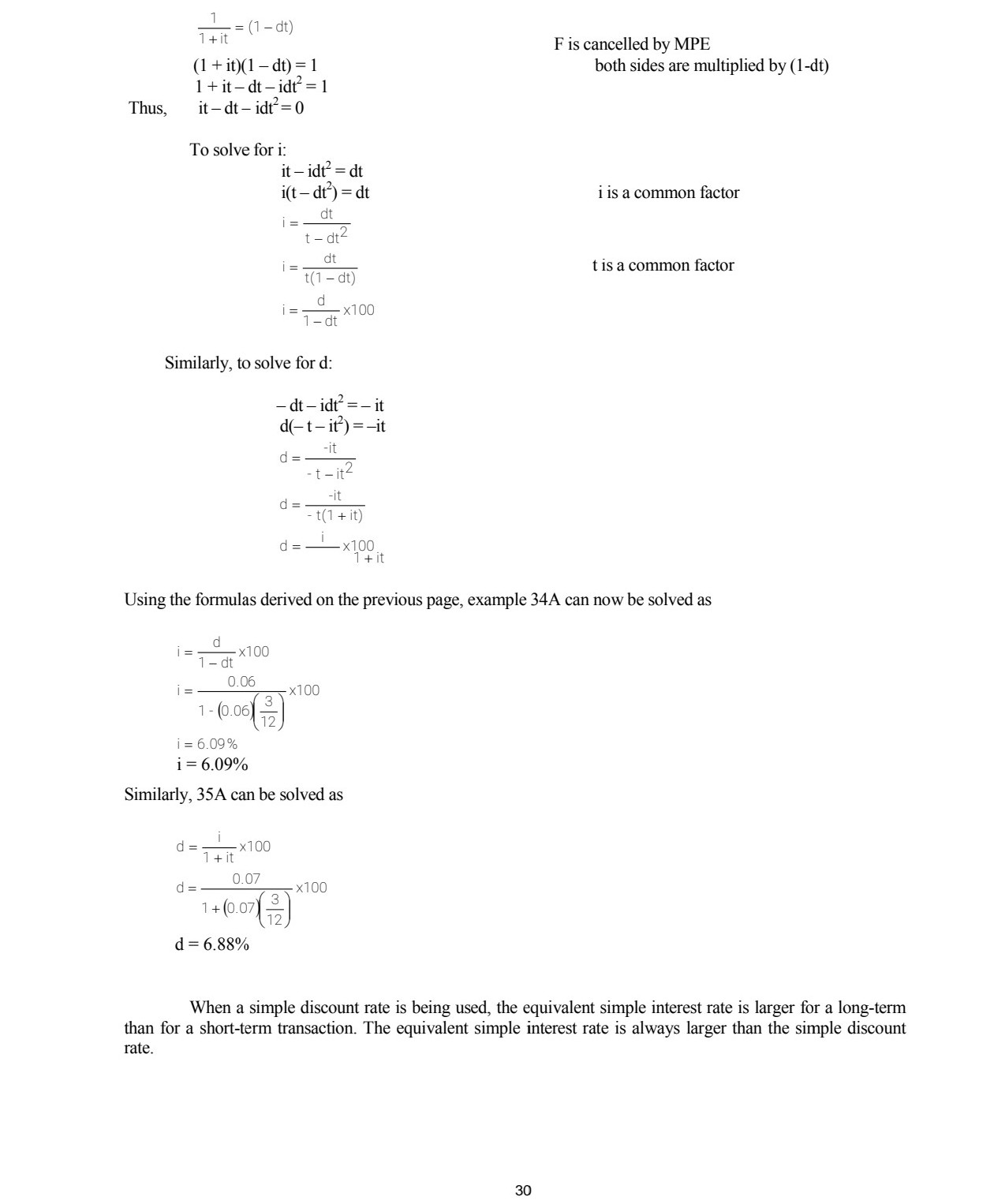

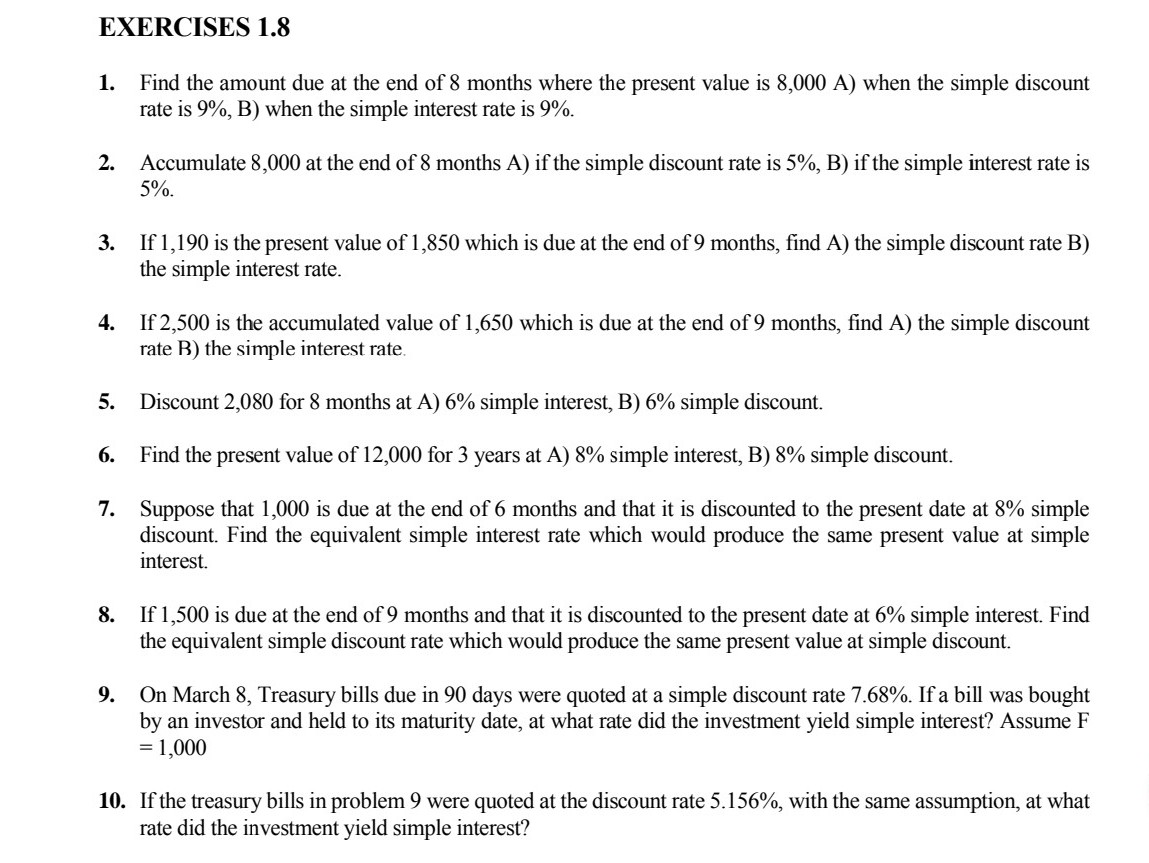

1.8 COMPARISON OF SIMPLE INTEREST AND SIMPLE DISCOUNT A simple interest rate i and a corresponding simple discount rate d are equivalent if the present value at simple discount d equals the present value at simple interest i. That is Pati = P atd F = F(1 - dt) 1 + it Example 34. What interest rate is equivalent to 6% simple discount rate in discounting an amount for A) 3 months and B) 6 months? Assume F=1,000. Solution: A. Given that F = 1,000, d = 6%, t= 3 months then P = F(1 - dt) P = 1000[1 - (0.06)(3/12)] P = 985 Since P at i = P at d then i= F-P Pt - X100 i= 1000 - 985 x100 (985) (15 )(12) (985)3) - x100 i = 6.09% 15 x 12 + 985 + 3 x 100 = 6.09 B. Given that F = 1,000, d = 6%, t = 6 months then P =F(1 - dt) P = 1000[1 - (0.06)(6/12)] P=970Since P at i = P at d then F-2 X100 Pt 1000 - 985 - x100 985) 12 2 x100 (985)6) i = 6.19% Example 35. What simple discount rate is equivalent to 7% simple interest rate in finding the present value of an amount due at the end of A) 3 months and B) 1 year? Assume F = 1,000. 1 + it Solution: A. From P = =, where F = 1,000, i = 7% and t = 3 months then P =. 1000 1+ (0.07) (72) P =982.80 1000 + ( 1 + 0.07 x 3 + 12 ) = 982.80 Since P at i = P at d then d = -2 x100 Ft d = 1000 - 982.80 x100 100012 d = (17.20)12 x100 (1000 )(3) d = 6.88% C. From P = F 1+ it -, where F = 1,000, i = 7% and t = 1 then 1000 P = - 1 + (0.07)(1) P = 934.58 Since P at i = P at d then d= F-P x100 Ft d = 1000 - 934.59 - x100 (1000 )(1) d = 6.54% Formulas can be obtained relating the simple discount rate d and the equivalent simple interest rate i. Pati = P atd 1 + it = F(1 - dt) 291 + it * = (1-dt) F is cancelled by MPE (1 + it)(1 - dt) = 1 both sides are multiplied by (1-dt) 1 + it - dt - idt- = 1 Thus, it - dt - idt- = 0 To solve for i: t - idt' = dt i(t - dt-) = dt i is a common factor dt t - d+2 dt = - t (1 - dt) t is a common factor d X100 1 - dt Similarly, to solve for d: - dt - idt' = - it d(-t - it') =-it d= -it - t - it 2 -it d = - - t(1 + it) d = - X100 1 + it Using the formulas derived on the previous page, example 34A can now be solved as i= X100 1 - dt 0.06 i= x100 1 - (0.06) i = 6.09% i = 6.09% Similarly, 35A can be solved as d = x100 It it 0.07 d = - X100 1 + (0.07) d = 6.88% When a simple discount rate is being used, the equivalent simple interest rate is larger for a long-term than for a short-term transaction. The equivalent simple interest rate is always larger than the simple discount rate 30EXERCISES 1.8 1. 9. 10. Find the amount due at the end of 8 months where the present value is 8,000 A) when the simple discount rate is 9%, B) when the simple interest rate is 9%. Accumulate 8,000 at the end of 8 months A) it\" the simple discount rate is 5%, B) if the simple interest rate is 5%. If 1,190 is the present value of 1,850 which is due at the end of 9 months, nd A) the simple discount rate B) the simple interest rate. If 2,500 is the accumulated value of 1,650 which is due at the end of 9 months, nd A) the simple discount rate Fl) the simple interest rate. Discount 2,080 for 8 months at A) 6% simple interest, B) 6% simple discount. Find the present value of 12,000 for 3 years at A) 8% simple interest, B) 8% simple discount. Suppose that 1,000 is due at the end of 6 months and that it is discounted to the present date at 8% simple discount. Find the equivalent simple interest rate which would produce the same present value at simple interest If 1,500 is due at the end of 9 months and that it is discounted to the present date at 6% simple interest Find the equivalent simple discount rate which would produce the same present value at simple discount. On March 8, Treasury bills due in 90 days were quoted at a simple discount rate 7.68%. If a bill was bought by an investor and held to its maturity date, at what rate did the investment yield simple interest? Assume F = 1,000 If the treasury bills in problem 9 were quoted at the discount rate 5.156%, with the same assumption, at what rate did the investment yield simple interest