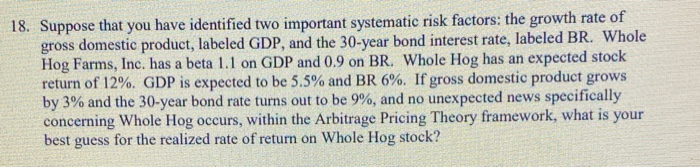

Question: 18. Suppose that you have identified two important systematic risk factors: the growth rate of gross domestic product, labeled GDP, and the 30-year bond interest

18. Suppose that you have identified two important systematic risk factors: the growth rate of gross domestic product, labeled GDP, and the 30-year bond interest rate, labeled BR. Whole Hog Farms, Inc. has a beta 1.1 on GDP and 0.9 on BR. Whole Hog has an expected stock return of 12%. GDP is expected to be 5.5% and BR 6%. If gross domestic product grows by 3% and the 30-year bond rate turns out to be 9%, and no unexpected news specifically concerning Whole Hog occurs, within the Arbitrage Pricing Theory framework, what is your best guess for the realized rate of return on Whole Hog stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock