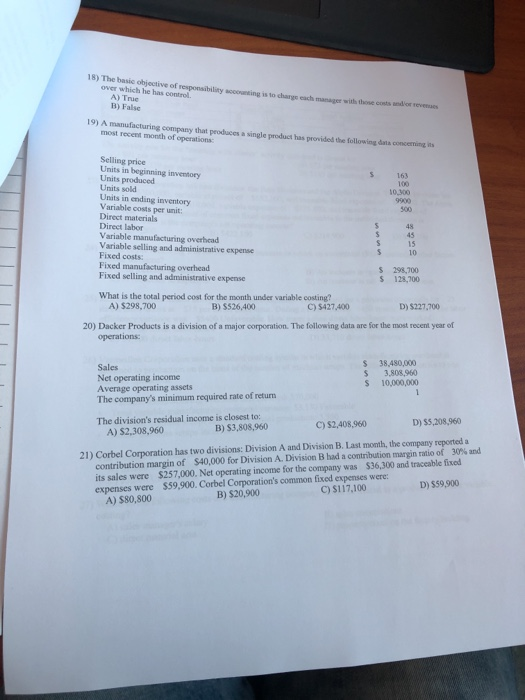

Question: 18) The basic objective of responsibility sccounting is to charge each manager with those costs andior sevenas over which he has control A) True B)

18) The basic objective of responsibility sccounting is to charge each manager with those costs andior sevenas over which he has control A) True B) False 19) A manufacturing company that peoduces a single product has provided the following data concerming its most recent month of operations Selling price Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs Fixed manufacturing overhead Fixed selling and administrative expense 163 100 10.300 9900 500 48 45 15 10 298,700 128.700 What is the total period cost for the month under variable costing? B) $526,400 C) $427,400- A) $298,700 D) $227,700 20) Dacker Products is a division of a major corporation. The following data are for the most recent year of operations: 38,480,000 3,808,960 10,000,000 Sales Net operating income Average operating assets The company's minimum required rate of return The division's residual income is closest to: A) $2,308,960 D) $5,208,960 C) $2,408,960 B) $3,808,960 21) Corbel Corporation has two divisions: Division A and Division B. Last month, the company reported a contribution margin of $40,000 for Division A. Division B had a contribution margin ratio of 30% and $257,000. Net operating income for the company was $36,300 and traceable fixed D) $59,900 $59,900. Corbel Corporation's common fixed expenses were C) S117,100 its sales were expenses were B) $20,900 A) $80,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts