Question: 18. The company SOFT, initially without debt, dedicated to developing software applications, decides to issue debt in order to raise capital to develop a new

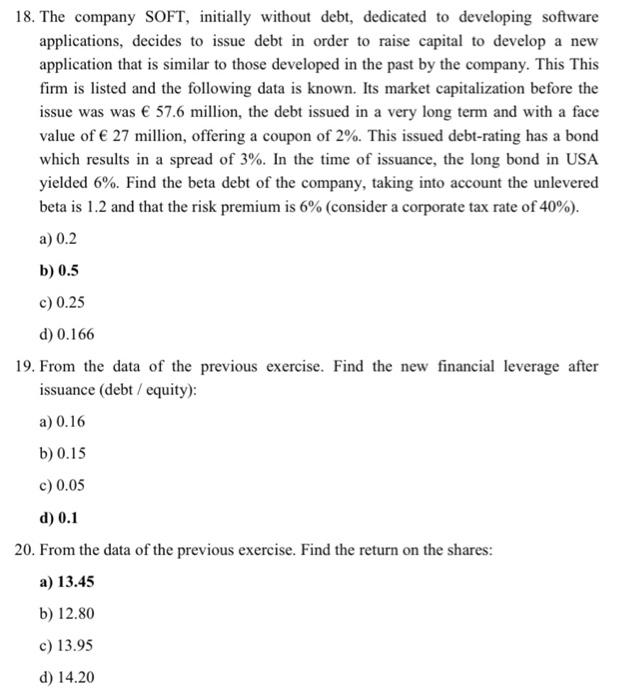

18. The company SOFT, initially without debt, dedicated to developing software applications, decides to issue debt in order to raise capital to develop a new application that is similar to those developed in the past by the company. This This firm is listed and the following data is known. Its market capitalization before the issue was was 57.6 million, the debt issued in a very long term and with a face value of 27 million, offering a coupon of 2%. This issued debt-rating has a bond which results in a spread of 3%. In the time of issuance, the long bond in USA yielded 6%. Find the beta debt of the company, taking into account the unlevered beta is 1.2 and that the risk premium is 6% (consider a corporate tax rate of 40%). a) 0.2 b) 0.5 c) 0.25 d) 0.166 19. From the data of the previous exercise. Find the new financial leverage after issuance (debt / equity): a) 0.16 b) 0.15 c) 0.05 d) 0.1 20. From the data of the previous exercise. Find the return on the shares: a) 13.45 b) 12.80 c) 13.95 d) 14.20 18. The company SOFT, initially without debt, dedicated to developing software applications, decides to issue debt in order to raise capital to develop a new application that is similar to those developed in the past by the company. This This firm is listed and the following data is known. Its market capitalization before the issue was was 57.6 million, the debt issued in a very long term and with a face value of 27 million, offering a coupon of 2%. This issued debt-rating has a bond which results in a spread of 3%. In the time of issuance, the long bond in USA yielded 6%. Find the beta debt of the company, taking into account the unlevered beta is 1.2 and that the risk premium is 6% (consider a corporate tax rate of 40%). a) 0.2 b) 0.5 c) 0.25 d) 0.166 19. From the data of the previous exercise. Find the new financial leverage after issuance (debt / equity): a) 0.16 b) 0.15 c) 0.05 d) 0.1 20. From the data of the previous exercise. Find the return on the shares: a) 13.45 b) 12.80 c) 13.95 d) 14.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts