Question: 18. The NAV Method includes the following: a. Review the REIT's properties by segment and location, b. Determine an appropriate cap rate for each group

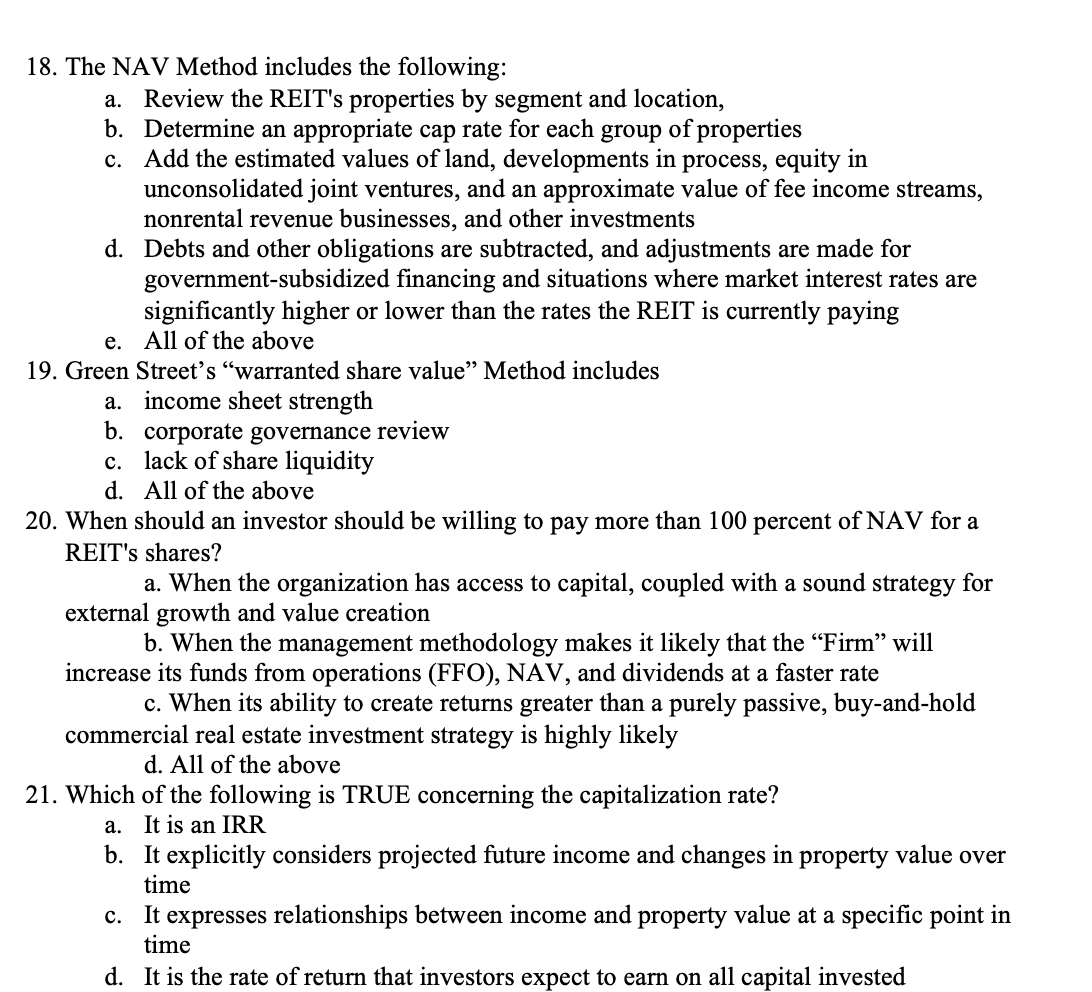

18. The NAV Method includes the following: a. Review the REIT's properties by segment and location, b. Determine an appropriate cap rate for each group of properties c. Add the estimated values of land, developments in process, equity in unconsolidated joint ventures, and an approximate value of fee income streams, nonrental revenue businesses, and other investments d. Debts and other obligations are subtracted, and adjustments are made for government-subsidized financing and situations where market interest rates are significantly higher or lower than the rates the REIT is currently paying e. All of the above 19. Green Street's "warranted share value Method includes a. income sheet strength b. corporate governance review c. lack of share liquidity d. All of the above 20. When should an investor should be willing to pay more than 100 percent of NAV for a REIT's shares? a. When the organization has access to capital, coupled with a sound strategy for external growth and value creation b. When the management methodology makes it likely that the Firm will increase its funds from operations (FFO), NAV, and dividends at a faster rate c. When its ability to create returns greater than a purely passive, buy-and-hold commercial real estate investment strategy is highly likely d. All of the above 21. Which of the following is TRUE concerning the capitalization rate? a. It is an IRR b. It explicitly considers projected future income and changes in property value over time c. It expresses relationships between income and property value at a specific point in time d. It is the rate of return that investors expect to earn on all capital invested

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts