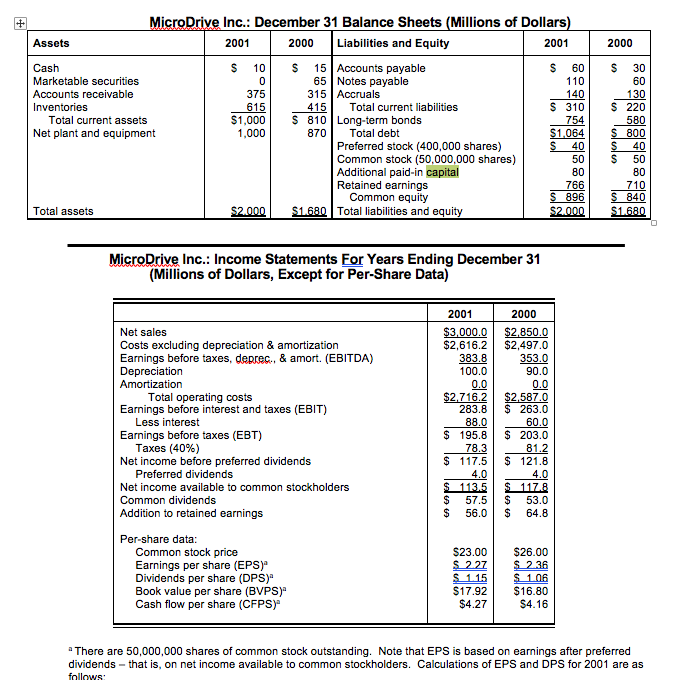

Question: 18. Using the MicroDrive data , calculate the EVA for 2000. Assume that the TOC is 1,455 and the required rate of return is 10

18. Using the MicroDrive data, calculate the EVA for 2000. Assume that the TOC is 1,455 and the required rate of return is 10 percent.

Group of answer choices

a. $10.6 million

b. $12.3 million

c. $14.5 million

d. $21.8 million

+ 2000 MicroDrive Inc.: December 31 Balance Sheets (Millions of Dollars) Assets 2001 2000 Liabilities and Equity 2001 Cash S 10 $ 15 Accounts payable S 60 Marketable securities 0 65 Notes payable 110 Accounts receivable 375 315 Accruals 140 Inventories 615 415 Total current liabilities $ 310 Total current assets $1,000 $ 810 Long-term bonds 754 Net plant and equipment 1,000 870 Total debt $1.064 Preferred stock (400,000 shares) S 40 Common stock (50,000,000 shares) 50 Additional paid-in capital 80 Retained earnings 766 Common equity $ 896 Total assets $2.000 $1.600 Total liabilities and equity $2.000 S 30 60 130 $ 220 580 $ 800 S 40 S 50 80 710 S 840 $1.680 MicroDrive Inc.: Income Statements For Years Ending December 31 (Millions of Dollars, Except for Per-Share Data) Net sales Costs excluding depreciation & amortization Earnings before taxes, deprec., & amort. (EBITDA) Depreciation Amortization Total operating costs Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes (40%) Net income before preferred dividends Preferred dividends Net income available to common stockholders Common dividends Addition to retained earnings Per-share data: Common stock price Earnings per share (EPS)" Dividends per share (DPS) Book value per share (BVPS)" Cash flow per share (CFPSY 2001 $3,000.0 $2,616.2 383.8 100.0 0.0 $2.716.2 283.8 88.0 $ 195.8 78.3 $ 117.5 4.0 $ 113.5 $ 57.5 $ 56.0 2000 $2.850.0 $2,497.0 353.0 90.0 0.0 $2.587.0 $ 263.0 60.0 $ 203.0 81.2 $ 121.8 4.0 $117.8 $ 53.0 $ 64.8 $23.00 S 2.27 S 1.15 $17.92 $4.27 $26.00 $ 236 $ 1.06 $16.80 $4.16 There are 50,000,000 shares of common stock outstanding. Note that EPS is based on earnings after preferred dividends - that is, on net income available to common stockholders. Calculations of EPS and DPS for 2001 are as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts