Question: 18.(10 points) You are analyzing two mutually exclusive projects (Small and Big) and have developed the following information. Assuming a 10% discount rate and also

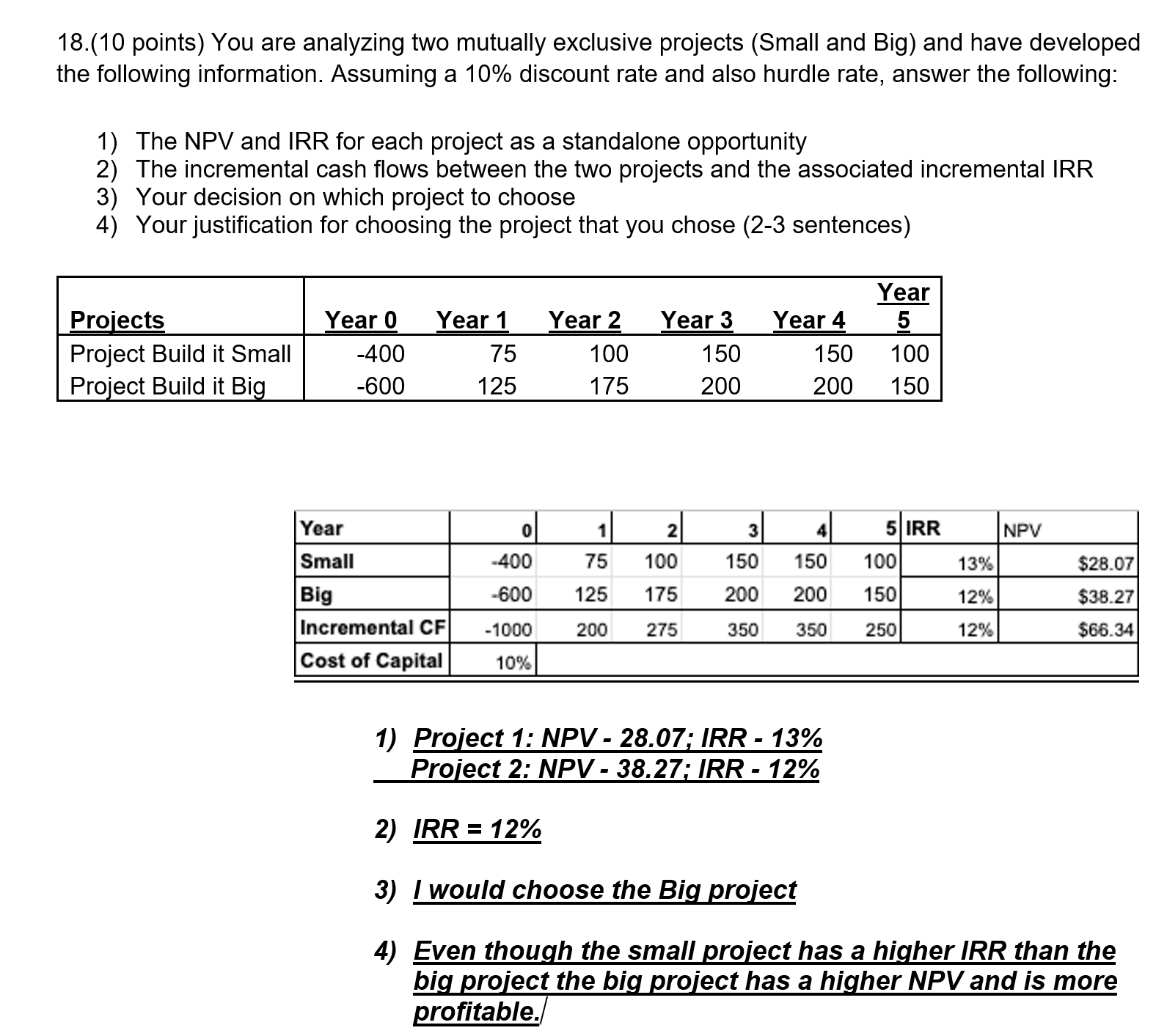

18.(10 points) You are analyzing two mutually exclusive projects (Small and Big) and have developed the following information. Assuming a 10\% discount rate and also hurdle rate, answer the following: 1) The NPV and IRR for each project as a standalone opportunity 2) The incremental cash flows between the two projects and the associated incremental IRR 3) Your decision on which project to choose 4) Your justification for choosing the project that you chose (2-3 sentences) 1) Project 1: NPV28.07;IRR13% Project 2: NPV - 38.27; IRR - 12\% 2) IRR=12% 3) I would choose the Big project 4) Even though the small project has a higher IRR than the big project the big project has a higher NPV and is more profitable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts