Question: 18.17 (LO 2, 3, 4) (One Reversing Difference, Future Deductible Amounts, One Tax Rate, No Beginning Deferred Taxes) Jenny Corporation recorded warranty accruals as at

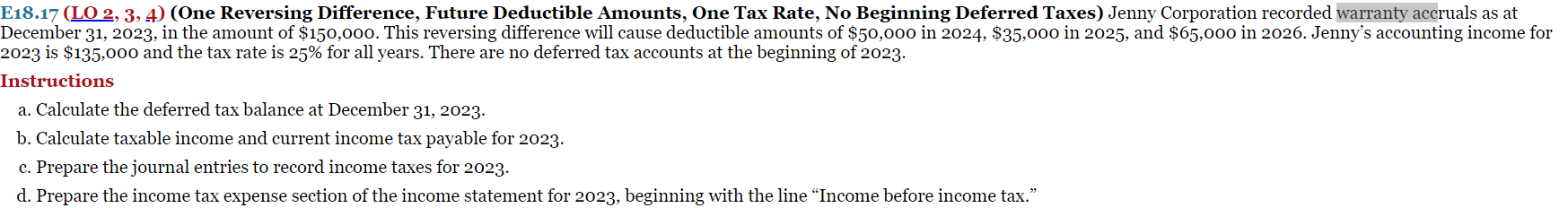

18.17 (LO 2, 3, 4) (One Reversing Difference, Future Deductible Amounts, One Tax Rate, No Beginning Deferred Taxes) Jenny Corporation recorded warranty accruals as at December 31,2023 , in the amount of $150, ooo. This reversing difference will cause deductible amounts of $50,000 in 2024 , $35,000 in 2025 , and $65, o0o in 2026 . Jenny's accounting income for 2023 is $135,000 and the tax rate is 25% for all years. There are no deferred tax accounts at the beginning of 2023 . instructions a. Calculate the deferred tax balance at December 31, 2023. b. Calculate taxable income and current income tax payable for 2023. c. Prepare the journal entries to record income taxes for 2023. d. Prepare the income tax expense section of the income statement for 2023 , beginning with the line "Income before income tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts