Question: 18.2 please neatly written please answer 18.2 and write neatly PUTS Foreigners and wint Any Terminal valor discontrate Spot exchange rate (PMS) Year o Spot

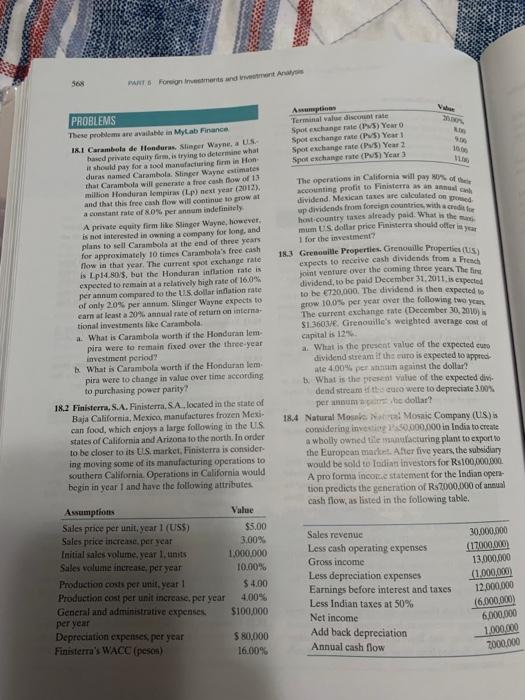

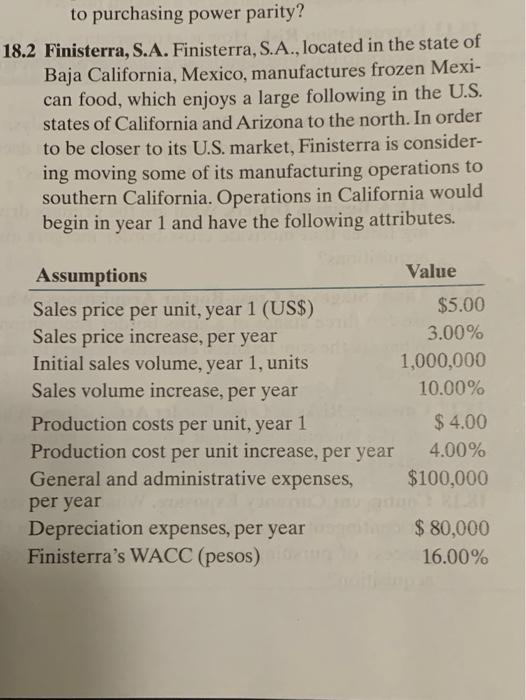

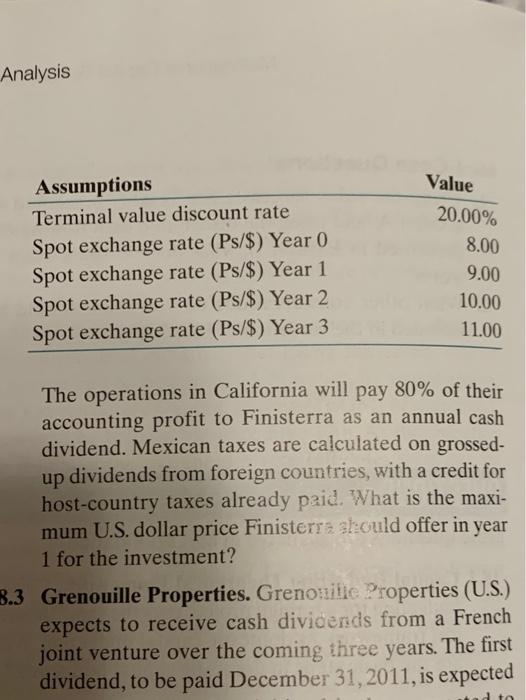

PUTS Foreigners and wint Any Terminal valor discontrate Spot exchange rate (PMS) Year o Spot exchange rate (P5) Year! Spot exchange rate (P3) Year 2 Spot exchange rate (PMS) Years PROBLEMS These problems are available in Mylab Finance IKI Carambola de Honduras Slinger Wayne, US hased private equity firm, is trying to determine what It should pay for a tool manufacturing firm in Hon duras named Carambola Slinger Wayne estimates that Carambola will generate a free cash flow of 13 million Honduran Lempiras (Lp) next year (2012). and that this free cash flow will continue to grow at a constant rate of 80% per annum indefinitely Aprivate equity firm like Slinger Wayne, however, is not interested in owning a company for long, and plans to sell Carambata at the end of three years for approximately 10 times Carambola's free cash flow in that year. The current spot exchange rate is Lp140$. but the Honduran inflation rate is expected to remain at a relatively high rate of 16,0% per annum compared to the US dollar inflation rate of only 20% per annum. Slinger Wayne expects to earn at least a 20% annual rate of return on interna tional investments like Carambola a. What is Carambola worth if the Honduran lem pira were to remain fixed over the three-year investment period What is Carambola worth if the Honduran lem. pira were to change in value over time according to purchasing power parity? 18.2 Finisterra, S.A. Finisterra, S.A., located in the state of Baja California, Mexico, manufactures frozen Mexi can food, which enjoys a large following in the US states of California and Arizona to the north order to be closer to its US market, Finisterra is consider ing moving some of its manufacturing operations to southern California. Operations in California would begin in year 1 and have the following attributes The operates in California will pay of accounting profit to Finance dividend Mexican Taxes are calculated up dividends from for countries with hot-country taxes already paid What is the mum US dollar price nister should offerinya 18. Grenouille Properties. Grenouille Properties (us) expects to receive cash dividends from each joint venture over the coming three years. The firs dividend, to be paid December 31, 2011. is expected to be 20,000. The dividend is the expected to grow 100% per year over the following two years The current exchange rate (December 30, 2010) $1.3600. Grenouille's weighted average cost of capital is 12 a. What is the present value of the expected cuto dividend stream is the cuto is expected to apprec te 400% per against the dollar? What is the present Value of the expected divi dead stream touro were to depreciate 3.00% per nome dollar 18.4 Natural Monte Mosaic Company (US) considering investis0.000.000 in India to create a wholly owned tile acturing plant to export to the European market. Aber five years, the subsidiary would be sold to Indian Investors for Rs100,000,000 A pro forma in statement for the Indian open- tion predicts the generation of R$7000.000 of annual cash flow, as listed in the following table. Assumptions Sales price per unit, year 1 (US) Sales price increase, per year Initial sales volume, year 1. units Sales volume increase, per year Production costs per unit year! Production cost per unit increase, per year General and administrative expenses per year Depreciation expenses per year Finisterra's WACC (peson) Value $5.00 3.00% 1.000.000 10.00% $ 4,00 4.00% $100,000 Sales revenue Less cash operating expenses Gross income Less depreciation expenses Earnings before interest and taxes Less Indian taxes at 50% Net income Add back depreciation Annual cash flow 30,000,000 (17000.000) 13.000.000 (1.000.000) 12,000,000 (6.000.000 6,000,000 1.000.000 2000,000 $80,000 16.00% to purchasing power parity? 18.2 Finisterra, S.A. Finisterra, S.A., located in the state of Baja California, Mexico, manufactures frozen Mexi- can food, which enjoys a large following in the U.S. states of California and Arizona to the north. In order to be closer to its U.S. market, Finisterra is consider- ing moving some of its manufacturing operations to southern California. Operations in California would begin in year 1 and have the following attributes. Assumptions Value Sales price per unit, year 1 (US$) $5.00 Sales price increase, per year 3.00% Initial sales volume, year 1, units 1,000,000 Sales volume increase, per year 10.00% Production costs per unit, year 1 $ 4.00 Production cost per unit increase, per year 4.00% General and administrative expenses, $100,000 per year Depreciation expenses, per year $ 80,000 Finisterra's WACC (pesos) 16.00% Analysis Assumptions Terminal value discount rate Spot exchange rate (Ps/$) Year 0 Spot exchange rate (Ps/$) Year 1 Spot exchange rate (Ps/$) Year 2 Spot exchange rate (Ps/$) Year 3 Value 20.00% 8.00 9.00 10.00 11.00 The operations in California will pay 80% of their accounting profit to Finisterra as an annual cash dividend. Mexican taxes are calculated on grossed- up dividends from foreign countries, with a credit for host-country taxes already paid. What is the maxi- mum U.S. dollar price Finisterra akould offer in year 1 for the investment? B.3 Grenouille Properties. Grenouille Properties (U.S.) expects to receive cash dividends from a French joint venture over the coming three years. The first dividend, to be paid December 31, 2011, is expected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts