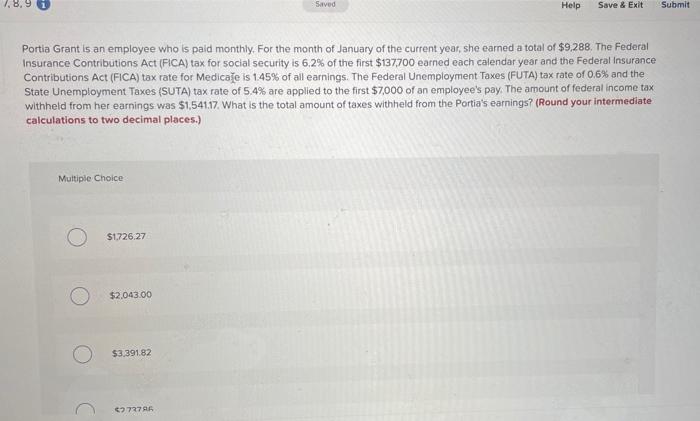

Question: 1.8.9 1 Sarved Help Save & Exit Submit Portia Grant is an employee who is paid monthly. For the month of January of the current

1.8.9 1 Sarved Help Save & Exit Submit Portia Grant is an employee who is paid monthly. For the month of January of the current year, she earned a total of $9,288. The Federal Insurance Contributions Act (FICA) tax for social security is 6,2% of the first $137700 earned each calendar year and the Federal Insurance Contributions Act (FICA) tax rate for Medicale is 145% of all earnings. The Federal Unemployment Taxes (FUTA) tax rate of 0.6% and the State Unemployment Taxes (SUTA) tax rate of 5.4% are applied to the first $7,000 of an employee's pay. The amount of federal income tax withheld from her earnings was $1,54117 What is the total amount of taxes withheld from the Portia's earnings? (Round your intermediate calculations to two decimal places.) Multiple Choice $1726.27 $2,043.00 $3,391.82 5272795 Multiple Choice $172627 $2043.00 $3.39082 52.73786 52.2517

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts