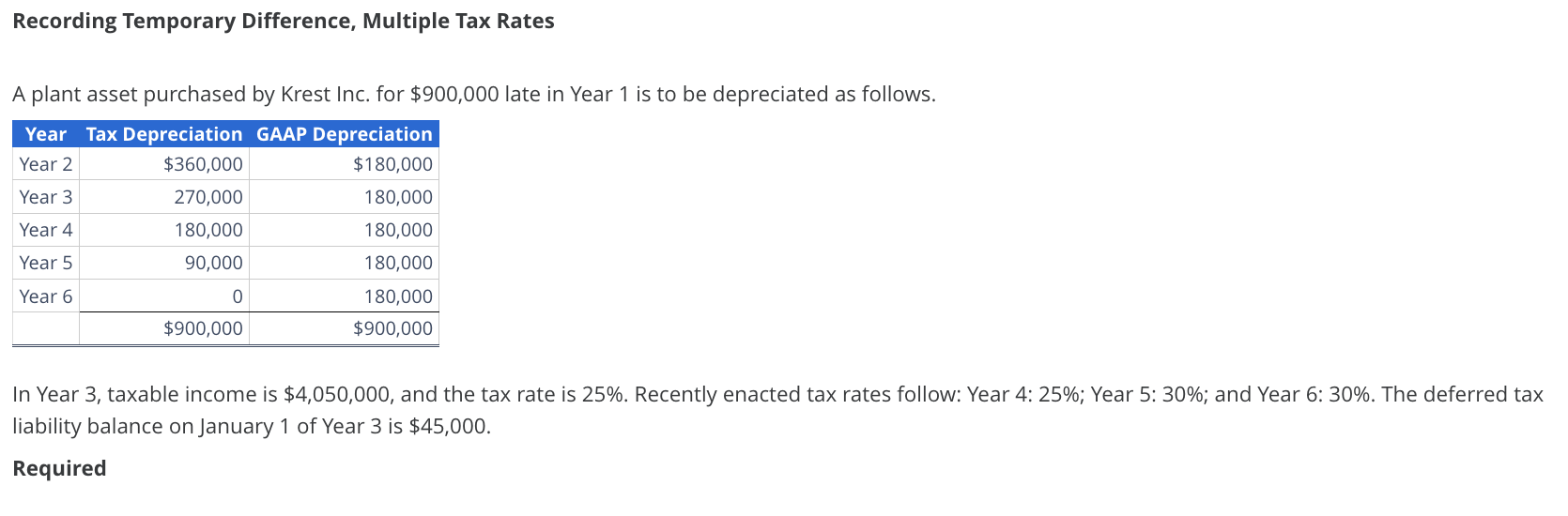

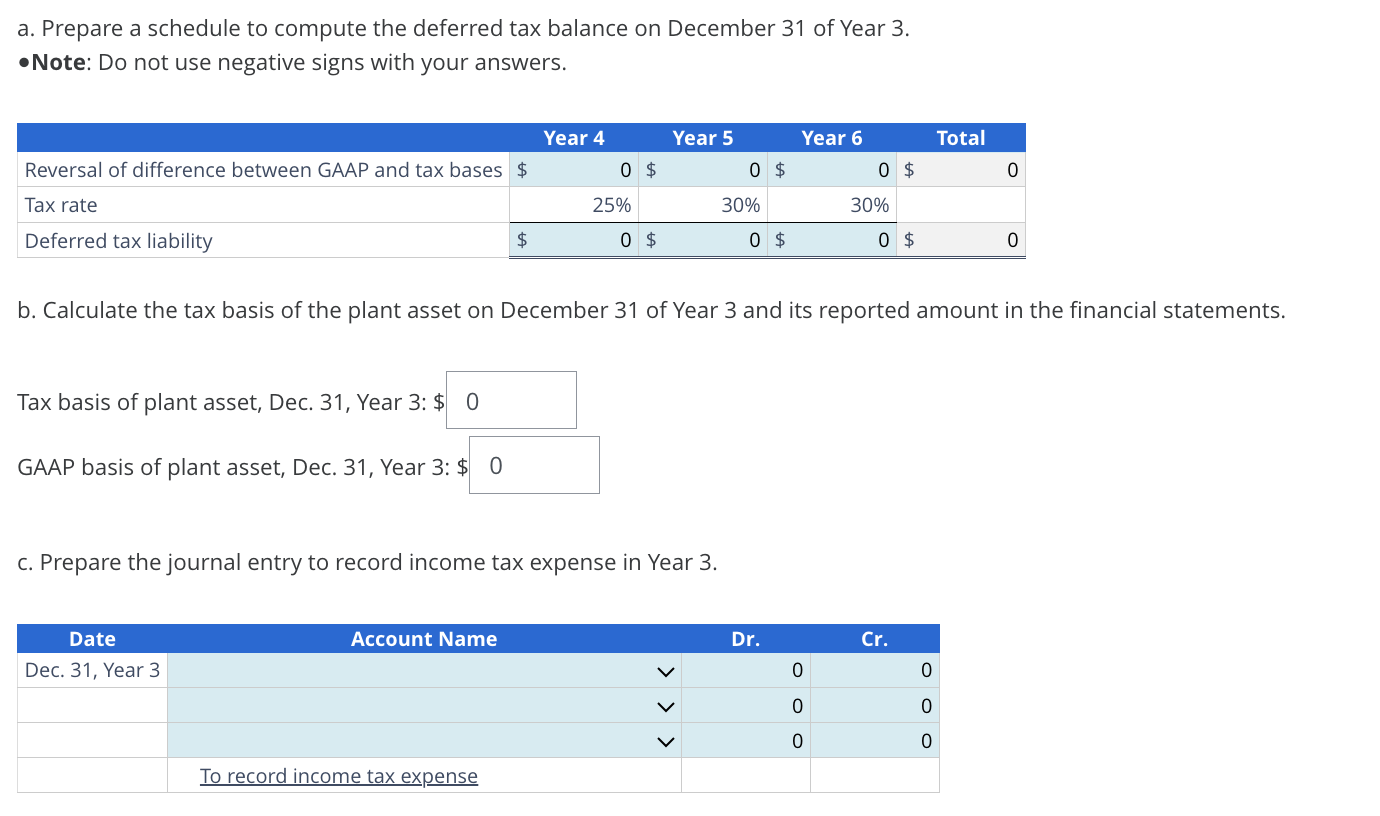

Question: (18-III-3) Please help me solve this problem and provide an explanation. Recording Temporary Difference, Multiple Tax Rates A plant asset purchased by Krest Inc. for

(18-III-3) Please help me solve this problem and provide an explanation.

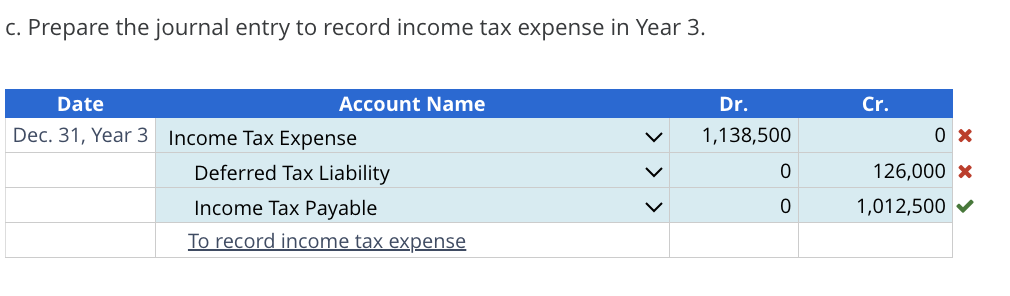

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock