Question: (19) A coupon bond is reported as having a flat price of 113% of the $1,000 par value in the Wall Street Journal. If the

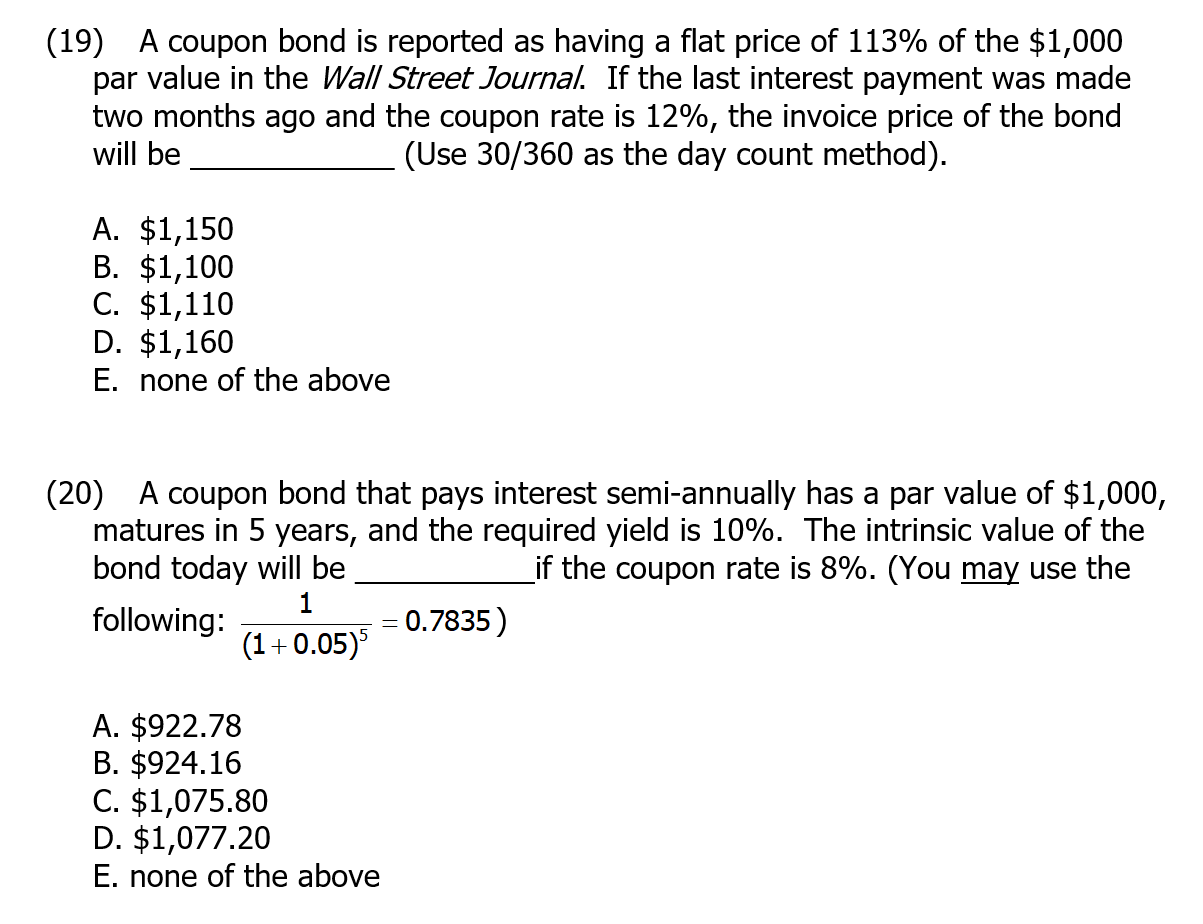

(19) A coupon bond is reported as having a flat price of 113% of the $1,000 par value in the Wall Street Journal. If the last interest payment was made two months ago and the coupon rate is 12%, the invoice price of the bond will be (Use 30/360 as the day count method). A. $1,150 B. $1,100 C. $1,110 D. $1,160 E. none of the above (20) A coupon bond that pays interest semi-annually has a par value of $1,000, matures in 5 years, and the required yield is 10%. The intrinsic value of the bond today will be Lif the coupon rate is 8%. (You may use the following: = 0.7835) (1+0.05) 1 A. $922.78 B. $924.16 C. $1,075.80 D. $1,077.20 E. none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts