Question: 19) A project has expected cash inflows, starting with Year 1, of $900, $1,200, $1,500, and finally in Year 4, $2,000. The profitability index is

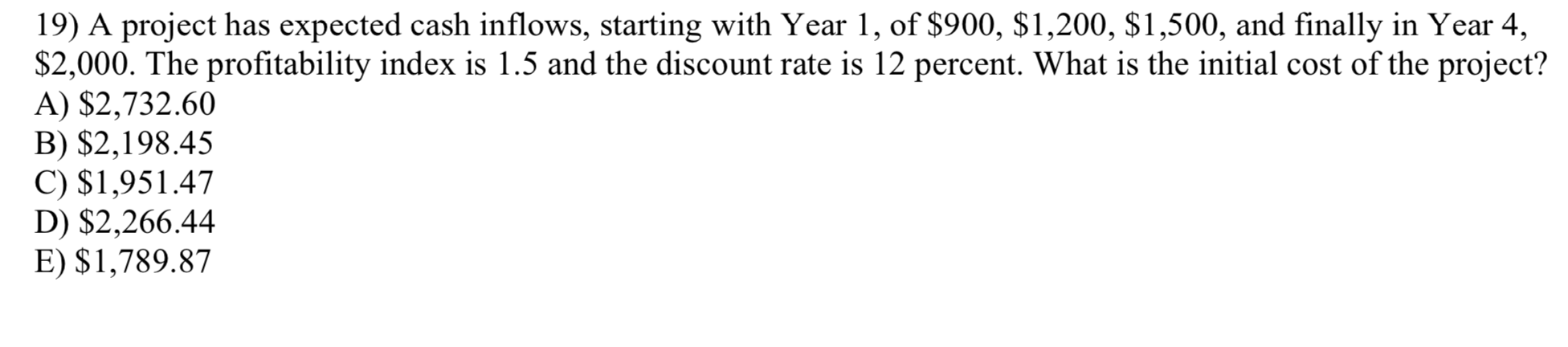

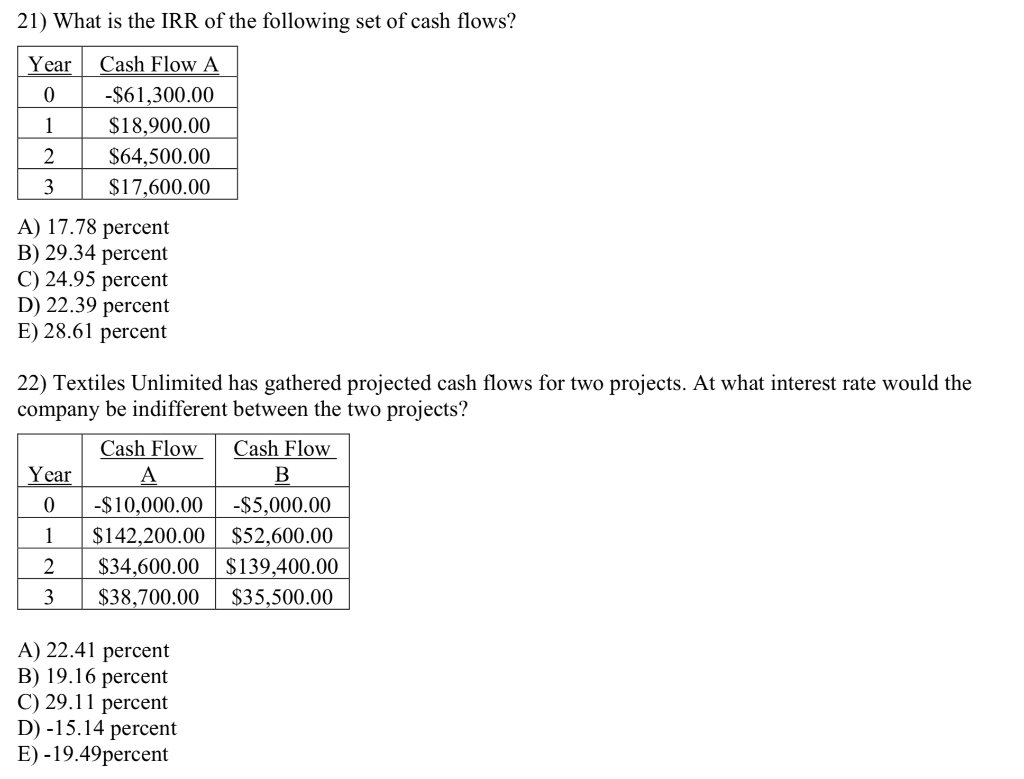

19) A project has expected cash inflows, starting with Year 1, of $900, $1,200, $1,500, and finally in Year 4, $2,000. The profitability index is 1.5 and the discount rate is 12 percent. What is the initial cost of the project? A) $2,732.60 B) $2,198.45 C) $1,951.47 D) $2,266.44 E) $1,789.87 21) What is the IRR of the following set of cash flows? Year 0 1 2 3 Cash Flow A $61,300.00 $18,900.00 $64,500.00 $17,600.00 A) 17.78 percent B) 29.34 percent C) 24.95 percent D) 22.39 percent E) 28.61 percent 22) Textiles Unlimited has gathered projected cash flows for two projects. At what interest rate would the company be indifferent between the two projects? Cash Flow B Year 10 Cash Flow -$10,000.00 $142.200.00 $34,600.00 $38,700.00 $5,000.00 $52,600.00 $139,400.00 $35,500.00 2 3 A) 22.41 percent B) 19.16 percent C) 29.11 percent D)-15.14 percent E) -19.49percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts