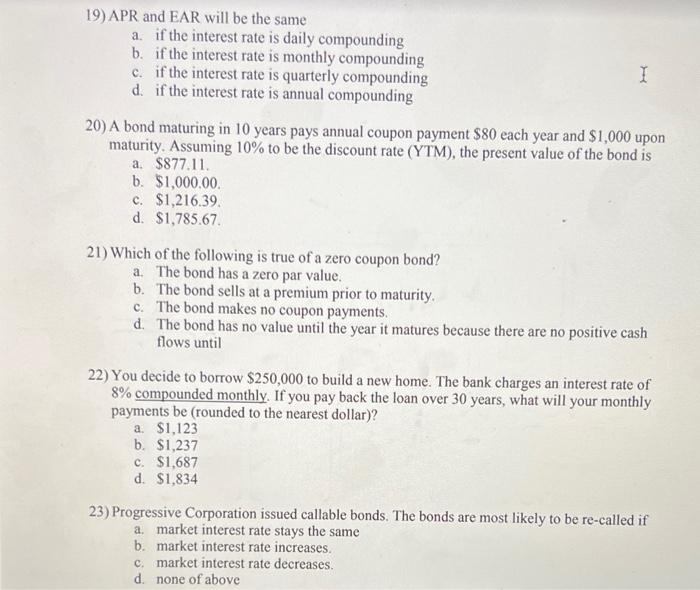

Question: 19) APR and EAR will be the same a. if the interest rate is daily compounding b. if the interest rate is monthly compounding c.

19) APR and EAR will be the same a. if the interest rate is daily compounding b. if the interest rate is monthly compounding c. if the interest rate is quarterly compounding 1 d. if the interest rate is annual compounding 20) A bond maturing in 10 years pays annual coupon payment $80 each year and $1,000 upon maturity. Assuming 10% to be the discount rate (YTM), the present value of the bond is a. $877.11. b. $1,000.00 c. $1,216.39. d. $1,785.67. 21) Which of the following is true of a zero coupon bond? a. The bond has a zero par value. b. The bond sells at a premium prior to maturity. c. The bond makes no coupon payments. d. The bond has no value until the year it matures because there are no positive cash flows until 22) You decide to borrow $250,000 to build a new home. The bank charges an interest rate of 8% compounded monthly. If you pay back the loan over 30 years, what will your monthly payments be (rounded to the nearest dollar)? a $1,123 b. $1,237 c. $1,687 d. $1,834 23) Progressive Corporation issued callable bonds. The bonds are most likely to be re-called if a market interest rate stays the same b. market interest rate increases. c. market interest rate decreases. d. none of above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts