Question: 19) In the last example, we determined that Delta has a DTA of $40,000 related to the $100,000 NOL in 2015. In 2016, it decides

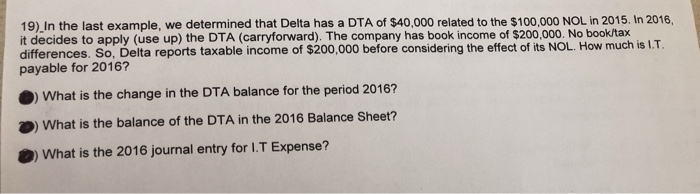

19) In the last example, we determined that Delta has a DTA of $40,000 related to the $100,000 NOL in 2015. In 2016, it decides to apply (use up) the DTA (carryforward). The company has book income of $200,000. No book/tax differences. So, Delta reports taxable income of $200,000 before considering the effect of its NOL. How much is LT. payable for 2016? What is the change in the DTA balance for the period 2016? What is the balance of the DTA in the 2016 Balance Sheet? What is the 2016 journal entry for IT Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts