Question: 19. Jefferson & Sons is evaluating a project that will increase annual sales by $138,000 and annual costs by $94,000. The project will initially require

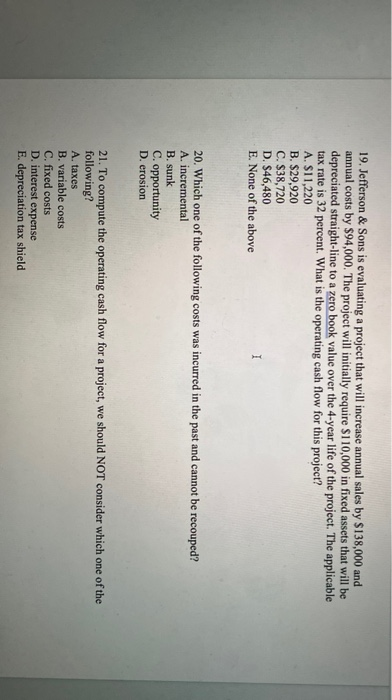

19. Jefferson & Sons is evaluating a project that will increase annual sales by $138,000 and annual costs by $94,000. The project will initially require $110,000 in fixed assets that will be depreciated straight-line to a zero book value over the 4-year life of the project. The applicable tax rate is 32 percent. What is the operating cash flow for this project? A. $11,220 B. $29,920 C. $38,720 D. $46,480 I E. None of the above 20. Which one of the following costs was incurred in the past and cannot be recouped? A. incremental B. sunk C. opportunity D. erosion 21. To compute the operating cash flow for a project, we should NOT consider which one of the following? A. taxes B. variable costs C. fixed costs D. interest expense E. depreciation tax shield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts