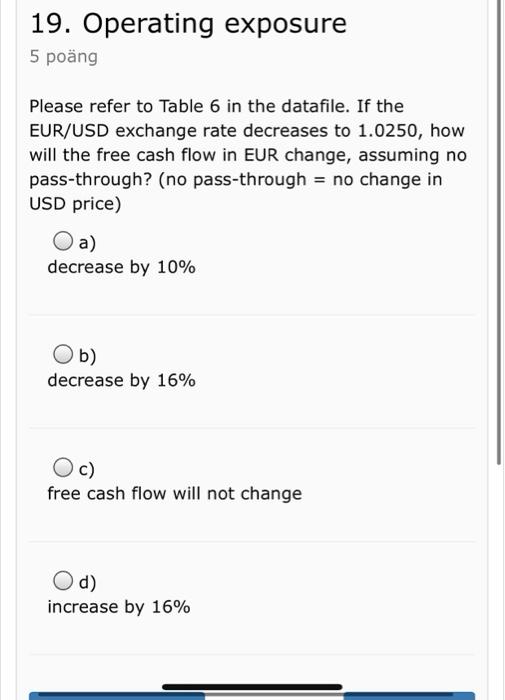

Question: 19. Operating exposure 5 pong Please refer to Table 6 in the datafile. If the EUR/USD exchange rate decreases to 1.0250, how will the free

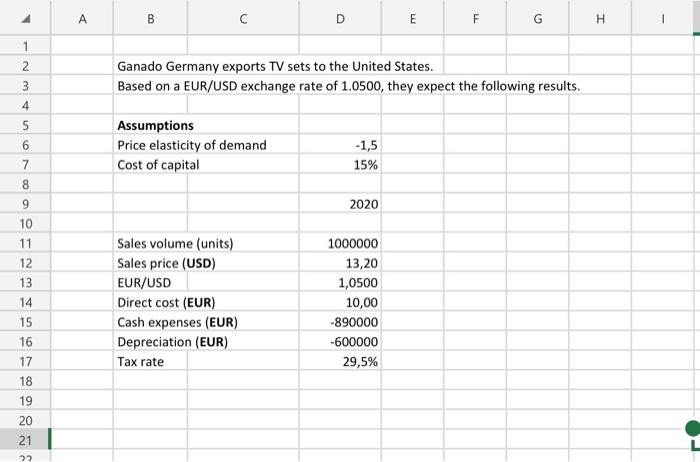

19. Operating exposure 5 pong Please refer to Table 6 in the datafile. If the EUR/USD exchange rate decreases to 1.0250, how will the free cash flow in EUR change, assuming no pass-through? (no pass-through = no change in USD price) a) decrease by 10% Ob) decrease by 16% c) free cash flow will not change d) increase by 16% A A B B D E F F G H 4 1 1 2 w N Ganado Germany exports TV sets to the United States. Based on a EUR/USD exchange rate of 1.0500, they expect the following results. 3 4 5 Assumptions Price elasticity of demand Cost of capital -1,5 15% 2020 6 7 8 9 10 11 12 13 14 Sales volume (units) Sales price (USD) EUR/USD Direct cost (EUR) Cash expenses (EUR) Depreciation (EUR) Tax rate 1000000 13,20 1,0500 10,00 -890000 -600000 29,5% 15 16 17 18 19 20 21 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts