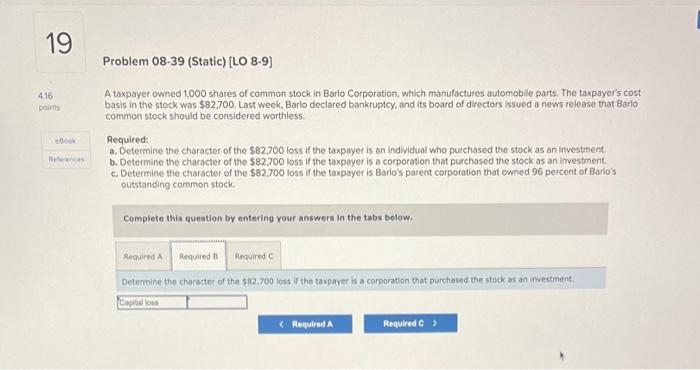

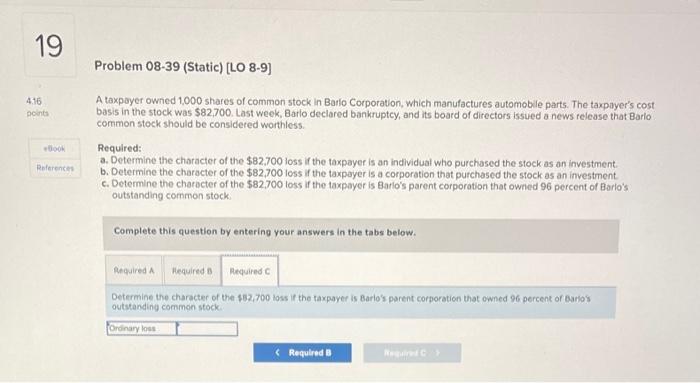

Question: 19 Problem 08-39 (Static) [LO 8-9] 416 points eBook References A taxpayer owned 1,000 shares of common stock in Barlo Corporation, which manufactures automobile parts.

![19 Problem 08-39 (Static) [LO 8-9] 416 points eBook References A](https://s3.amazonaws.com/si.experts.images/answers/2024/06/6661ef3bb424e_2676661ef3b49afe.jpg)

19 Problem 08-39 (Static) [LO 8-9] 416 points eBook References A taxpayer owned 1,000 shares of common stock in Barlo Corporation, which manufactures automobile parts. The taxpayer's cost basis in the stock was $82,700. Last week, Barlo declared bankruptcy, and its board of directors issued a news release that Barlo common stock should be considered worthless. Required: a. Determine the character of the $82.700 loss if the taxpayer is an individual who purchased the stock as an investment. b. Determine the character of the $82,700 loss if the taxpayer is a corporation that purchased the stock as an investment. c. Determine the character of the $82,700 loss if the taxpayer is Barlo's parent corporation that owned 96 percent of Barlo's outstanding common stock. Complete this question by entering your answers in the tabs below. Required A Required B Required C Determine the character of the $82,700 loss if the taxpayer is an individual who purchased the stock as an investment. Capital loss Regine A Required B> 19 4.16 points eBook References Problem 08-39 (Static) [LO 8-9] A taxpayer owned 1,000 shares of common stock in Barlo Corporation, which manufactures automobile parts. The taxpayer's cost basis in the stock was $82,700. Last week, Barlo declared bankruptcy, and its board of directors issued a news release that Barlo common stock should be considered worthless. Required: a. Determine the character of the $82,700 loss if the taxpayer is an individual who purchased the stock as an investment. b. Determine the character of the $82,700 loss if the taxpayer is a corporation that purchased the stock as an investment. c. Determine the character of the $82,700 loss if the taxpayer is Barlo's parent corporation that owned 96 percent of Barlo's outstanding common stock. Complete this question by entering your answers in the tabs below. Required A Required B Required C Determine the character of the $82,700 loss if the taxpayer is a corporation that purchased the stock as an investment. Capital loss 19 416 points References Problem 08-39 (Static) [LO 8-9) A taxpayer owned 1,000 shares of common stock in Barlo Corporation, which manufactures automobile parts. The taxpayer's cost basis in the stock was $82,700. Last week, Barlo declared bankruptcy, and its board of directors issued a news release that Barlo common stock should be considered worthless. Required: a. Determine the character of the $82,700 loss if the taxpayer is an individual who purchased the stock as an investment. b. Determine the character of the $82,700 loss if the taxpayer is a corporation that purchased the stock as an investment c. Determine the character of the $82.700 loss if the taxpayer is Barlo's parent corporation that owned 96 percent of Barlo's outstanding common stock. Complete this question by entering your answers in the tabs below. Required A Required Required C Determine the character of the $82,700 loss if the taxpayer is Barlo's parent corporation that owned 96 percent of Bario's outstanding common stock. Ordinary loss Required B Required C >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts