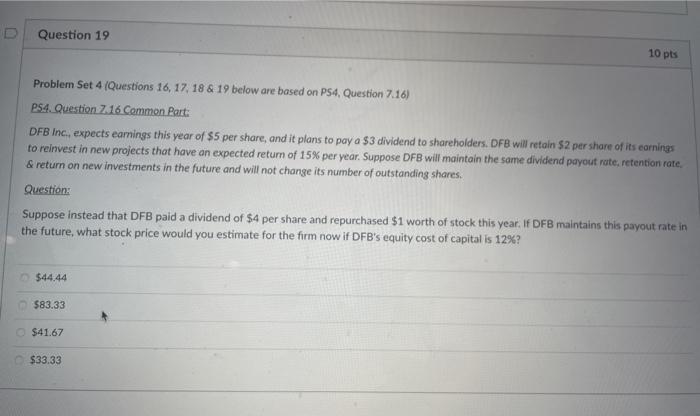

Question: 19 Question 19 10 pts Problem Set 4 (Questions 16, 17, 18 & 19 below are based on PS4. Question 7.16) PS4. Question 7.16 Common

Question 19 10 pts Problem Set 4 (Questions 16, 17, 18 & 19 below are based on PS4. Question 7.16) PS4. Question 7.16 Common Part: DFB Inc, expects earnings this year of $5 per share, and it plans to pay a $3 dividend to shareholders. DFB will retain $2 per share of its earnings to reinvest in new projects that have an expected return of 15% per year. Suppose DFB will maintain the same dividend payout rate, retention rate. & return on new investments in the future and will not change its number of outstanding shares. Question: Suppose instead that DFB paid a dividend of $4 per share and repurchased $1 worth of stock this year. If DFB maintains this payout rate in the future, what stock price would you estimate for the firm now if DFB's equity cost of capital is 12%? $44.44 $83.33 $41.67 $33.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts