Question: 19. To satisfy the completeness assertion, auditors verify that all merchandise received has been recorded by looking at a sample of a. vendors' invoices. b.

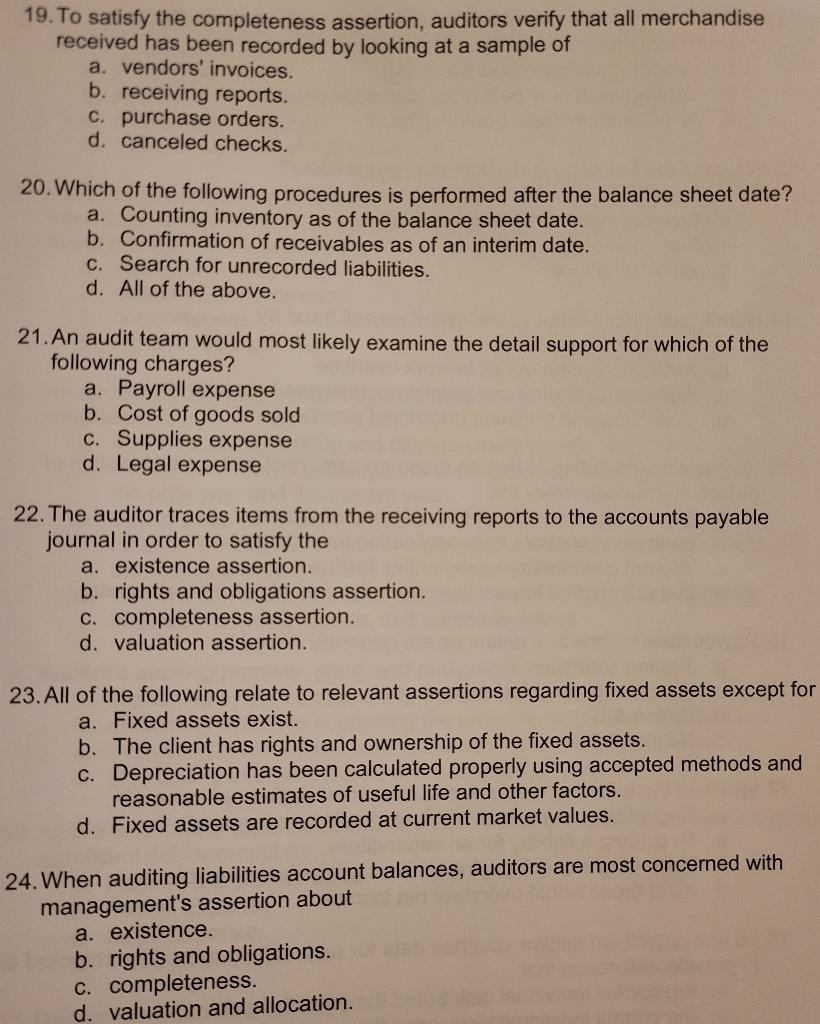

19. To satisfy the completeness assertion, auditors verify that all merchandise received has been recorded by looking at a sample of a. vendors' invoices. b. receiving reports. c. purchase orders. d. canceled checks. 20. Which of the following procedures is performed after the balance sheet date? a. Counting inventory as of the balance sheet date. b. Confirmation of receivables as of an interim date. c. Search for unrecorded liabilities. d. All of the above. 21. An audit team would most likely examine the detail support for which of the following charges? a. Payroll expense b. Cost of goods sold c. Supplies expense d. Legal expense 22. The auditor traces items from the receiving reports to the accounts payable journal in order to satisfy the a. existence assertion. b. rights and obligations assertion. c. completeness assertion. d. valuation assertion. 23. All of the following relate to relevant assertions regarding fixed assets except for a. Fixed assets exist. b. The client has rights and ownership of the fixed assets. c. Depreciation has been calculated properly using accepted methods and reasonable estimates of useful life and other factors. d. Fixed assets are recorded at current market values. 24. When auditing liabilities account balances, auditors are most concerned with management's assertion about a. existence. b. rights and obligations. c. completeness. d. valuation and allocation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts