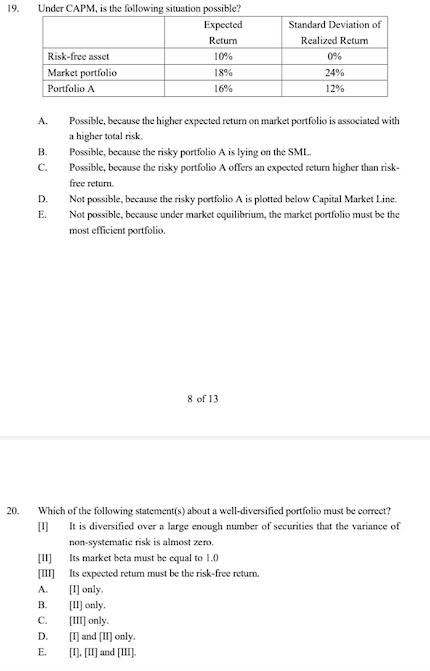

Question: 19. Under CAPM, is the following situation possible? Expected Return Risk-free asset 10% Market portfolio 18% Portfolio A 16% Standard Deviation of Realized Return 0%

19. Under CAPM, is the following situation possible? Expected Return Risk-free asset 10% Market portfolio 18% Portfolio A 16% Standard Deviation of Realized Return 0% 24% 12% A. B. C. Possible, because the higher expected return on market portfolio is associated with a higher total risk. Possible, because the risky portfolio A is lying on the SML. Possible, because the risky portfolio A offers an expected return higher than risk- free return Not possible, because the risky portfolio A is plotted below Capital Market Line. Not possible, because under market equilibrium, the market portfolio must be the most efficient portfolio D. E. 8 of 13 20. Which of the following statement(s) about a well-diversified portfolio must be correct? U It is diversified over a large enough number of securities that the variance of non-systematic risk is almost zero [11] Its market beta must be equal to 1.0 Its expected retum must be the risk-free return. U only. B. [1] only. C. [III] only. D. and [I only. E 1. [TIand [III) A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts