Question: 19) Using the quote shown above, if you use the last then the price of the Sep '16 contract would be A) 1020 B) $16,265.625

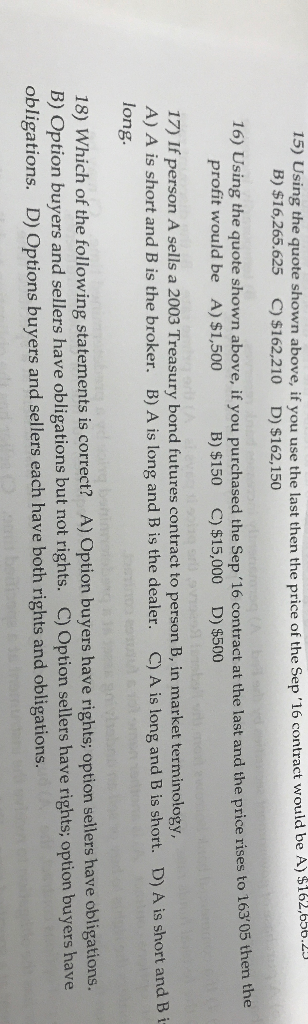

19) Using the quote shown above, if you use the last then the price of the Sep '16 contract would be A) 1020 B) $16,265.625 C) $162,210 D) $162,150 16) Using the quote shown above, if you purchased the Sep '16 contract at the last and the price rises to 1630 profit would be A) $1,500 B) $150 C) $15,000 D) $500 17) If person A sells a 2003 Treasury bond futures contract to person B, in market terminology, A) A is short and B is the broker. B) A is long and B is the dealer. C) A is long and B is short. D) A is short and 1 long. 18) Which of the following statements is correct? A) Option buyers have rights; option sellers have obligations. B) Option buyers and sellers have obligations but not rights. C) Option sellers have rights; option buyers have obligations. D) Options buyers and sellers each have both rights and obligations. 19) Using the quote shown above, if you use the last then the price of the Sep '16 contract would be A) 1020 B) $16,265.625 C) $162,210 D) $162,150 16) Using the quote shown above, if you purchased the Sep '16 contract at the last and the price rises to 1630 profit would be A) $1,500 B) $150 C) $15,000 D) $500 17) If person A sells a 2003 Treasury bond futures contract to person B, in market terminology, A) A is short and B is the broker. B) A is long and B is the dealer. C) A is long and B is short. D) A is short and 1 long. 18) Which of the following statements is correct? A) Option buyers have rights; option sellers have obligations. B) Option buyers and sellers have obligations but not rights. C) Option sellers have rights; option buyers have obligations. D) Options buyers and sellers each have both rights and obligations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts