Question: 19. What is the model called that determines the present value of a stock based on its next annual dividend, the dividend growth rate, and

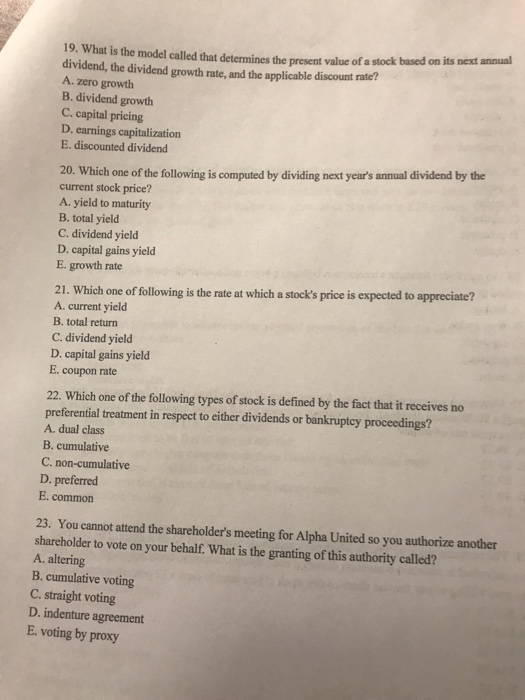

19. What is the model called that determines the present value of a stock based on its next annual dividend, the dividend growth rate, and the applicable discount rate? A. zero growth B. dividend growth C. capital pricing D. earnings capitalization E. discounted dividend 20. Which one of the following is computed by dividing next year's annual dividend by the current stock price? A. yield to maturity B. total yield C. dividend yield D. capital gains yield E. growth rate 21. Which one of following is the rate at which a stock's price is expected to appreciate? A. current yield B. total return C. dividend yield D. capital gains yield E. coupon rate 22. Which one of the following types of stock is defined by the fact that it receives no preferential treatment in respect to either dividends or bankruptcy proceedings? A. dual class B. cumulative C. non-cumulative D. preferred E. commorn 23. You cannot attend the shareholder's meeting for Alpha United so you authorize another shareholder to vote on your behalf. What is the granting of this authority called? A. altering B. cumulative voting C. straight voting D. indenture agreement E. voting by proxy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts